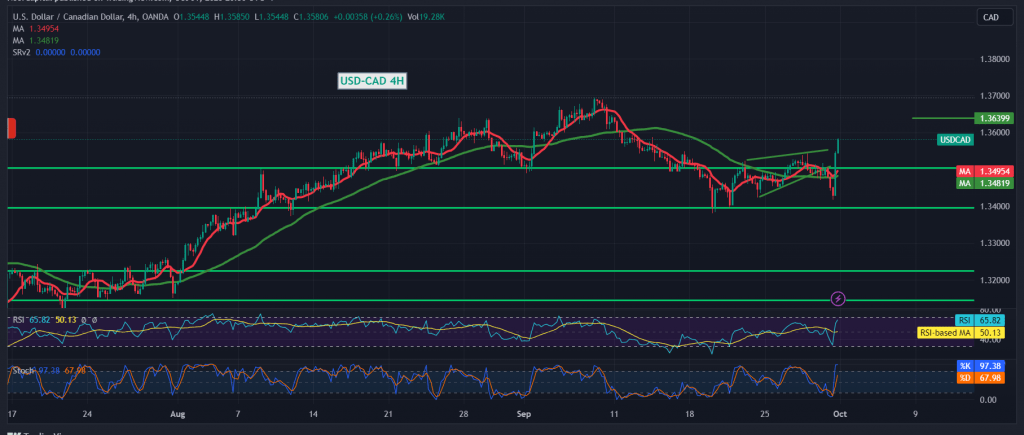

The Canadian dollar reversed the expected downward trend during the previous report, in which we relied on trading stability below the resistance level of 1.3520. As a reminder, we indicated that going above and consolidating the price above 1.3520 leads the pair to the upward path again as we wait for the price to head towards 1.3570, recording its highest level of 1.3585.

Technically, and with a closer look at the 4-hour time frame chart, we find that the pair breaks the psychological barrier resistance level of 1.3500, accompanied by the return of the simple moving averages to hold the price from below.

From here, with daily trading remaining above 1.3520, the upward bias is the most likely during the current trading session, targeting 1.3640 as the first target, and breaching it increases and accelerates the strength of the upward trend, opening the way directly to visit 1.3690.

Only from below is the return of trading stability below 1.3520, leading the pair to the downward path again as we initially waited for the price to head towards 1.3470.

Note: Today, we are awaiting high-impact economic data issued by the US economy, the Manufacturing Purchasing Managers’ Index, and the speech of Federal Reserve Chairman Jerome Powell, and we may witness high price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations