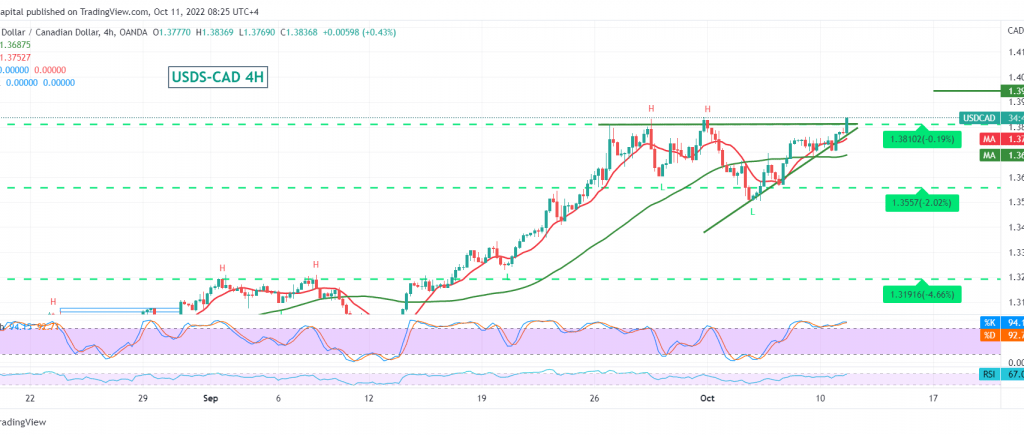

Remarkable rises dominate the movements of the Canadian dollar at the beginning of this week’s trading, taking advantage of the strong support floor at 1.3750.

Technically, the positive motive from the 50-day simple moving average supports the continuation of the rise and is motivated by positive momentum signals on the 60-minute time frame.

From here, and with steady daily trading above 1.3750, the bullish scenario remains valid and effective, targeting 1.3880, a first target, knowing that consolidation above the mentioned level can enhance the chances of touching 1.3920.

The return of trading stability below 1.3745 postpones the chances of rising but does not cancel them, and we may witness a bearish slope that aims to retest 1.3660 before it attempts to rise again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations