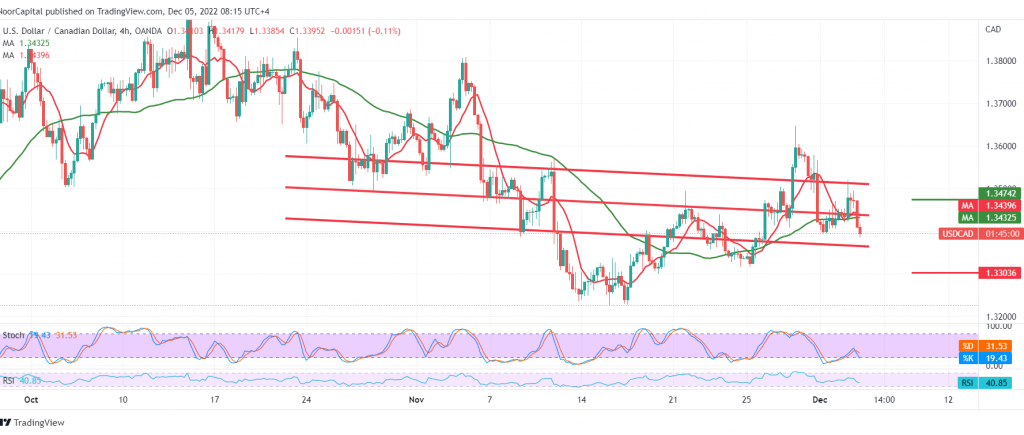

The Canadian dollar returned to the bearish path once again, after hitting the resistance level of the psychological barrier 1.3500, which forced it to trade negatively again, to witness the current movements stabilizing around its lowest level during the session 1.3385.

Technically, and by looking at the 4-hour chart, we find that the moving averages have returned to form an obstacle in front of the pair, and the 50-day average meets near 1.3480, adding more strength to it.

The bearish direction is the most likely during the day, knowing that the decline below 1.3350 extends the pair’s losses, so we are waiting to touch 1.3305, and the losses may extend later towards 1.3250.

Consolidation above 1.3480 can completely cancel the suggested scenario, and the pair may recover, with the first bullish target at 1.3560.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations