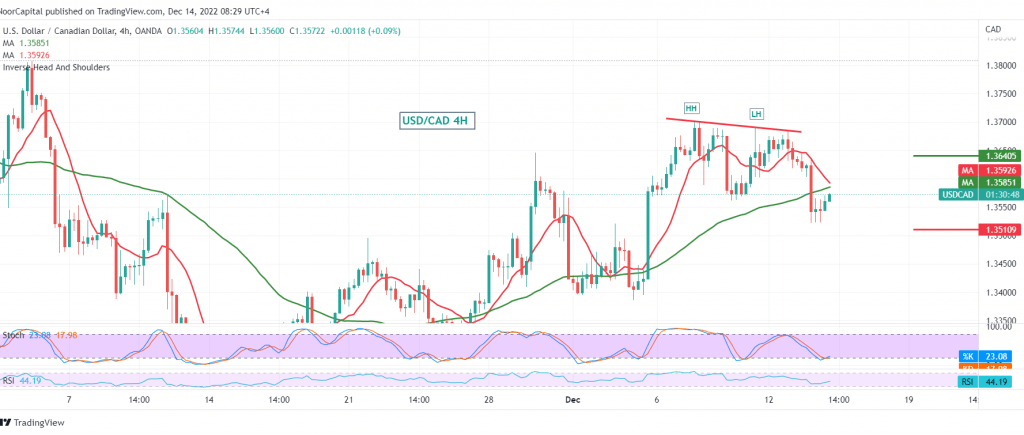

The Canadian dollar reversed the temporary trend, as we expected during the previous analysis after it failed to maintain its positive stability above the support level of 1.3600, explaining that the decline below the mentioned level will immediately stop any attempts to rise and lead the pair to the official bearish path, targeting 1.3570 and 1.3530, recording its lowest level at 1.3520.

Technically, and with trading remains below the aforementioned support at 1.3600, which is accompanied by the negative pressure of the simple moving averages, and the negative signals coming from the RSI.

Therefore, the bearish bias is the most likely during today’s trading session, targeting 1.3510 as the first target, and then 1.3455 as a next station, which requires trading stability below the resistance level of 1.3635.

Note: Today we are awaiting high-impact economic data from the United States of America, and we may witness high volatility:

Fed interest rates

Fed statement

Fed press conference

Economic forecasts

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations