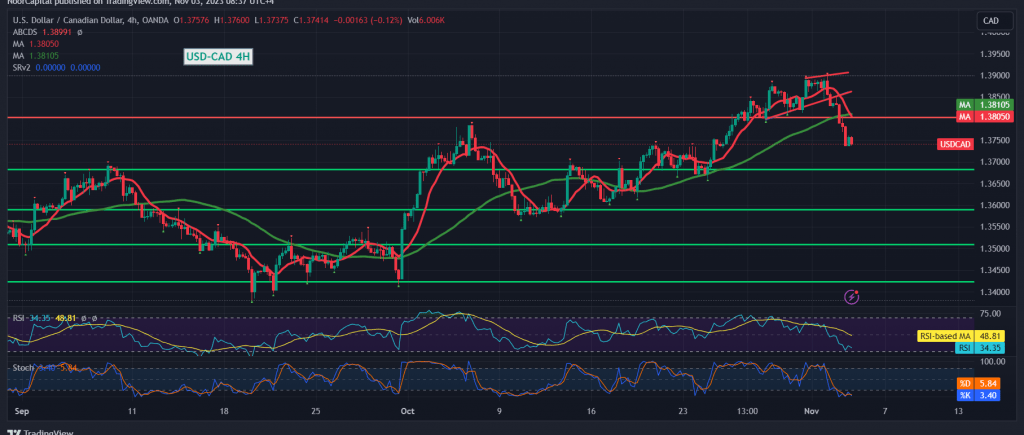

The Canadian dollar has successfully reached the anticipated bearish target outlined in the previous technical report. This forecast was based on the initial pressure observed on the support level of 1.3830, leading to a touchpoint at 1.3775. The currency pair recorded its lowest level at 1.3735 during this movement.

Upon a detailed analysis of the 4-hour chart, it is evident that the simple moving averages are persistently exerting downward pressure on the price from above. This aligns with the clear negative signals displayed on the Relative Strength Index.

Given the sustained trading below the previously breached support, now converted to a resistance level at 1.3830, the prevailing bearish sentiment remains strong. The next target is set at 1.3695, and a breakthrough at this level would extend the pair’s losses, paving the way directly towards 1.3650.

A reversal in the pair’s fortunes would only occur with the return of stable trading above the resistance level of 1.3830. Such a scenario would halt the downward trajectory, allowing the pair to potentially resume its upward trajectory with targets at 1.3905 and 1.3950, respectively.

Please note that we are anticipating high-impact economic data from the American economy, including non-farm payroll, unemployment rates, average wages, and the services purchasing managers index issued by ISM. Additionally, we are awaiting Canadian economic data, specifically the unemployment rate and job changes. Market fluctuations are expected upon the release of these news items.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations