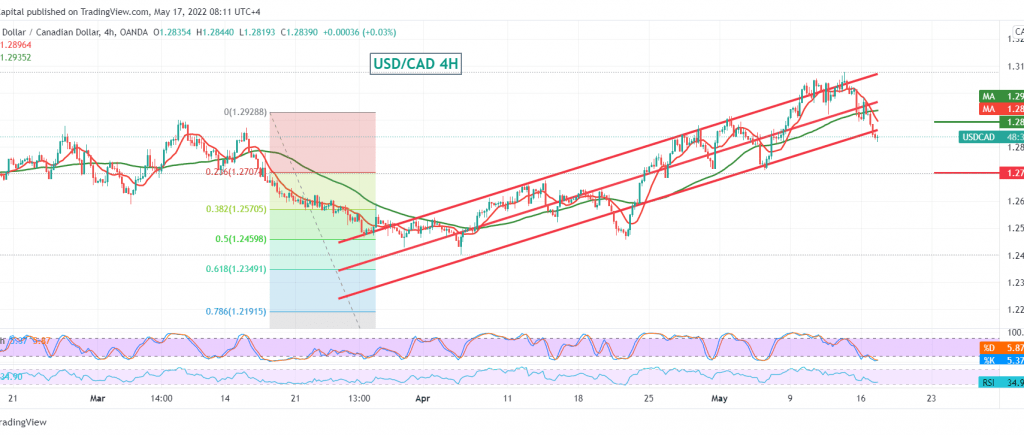

Strong negative trades dominated the Canadian dollar’s movements yesterday, nullifying the expected positive outlook during the previous analysis. As a result, we depended on trading stability above 12910, recording the lowest price at 1.2820.

Technically, we find the simple moving averages are back to pressure the price from above, and this comes in conjunction with the clear negative signs on the stochastic indicator.

From here, and with the stability of trading below the broken support level of 1.2880, the bearish bias is most preferred, targeting 1.2775, the first target, taking into account that the decline below the target level extends the pair’s losses, so we are waiting for 1.2720.

Activating the suggested bearish scenario depends on the stability of trading below 1.2885. The consolidation above it will stop the bearish scenario and lead the pair to initially complete the rise towards 1.2935.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations