The Canadian dollar displayed notable gains in the wake of the Central Bank of Canada’s decision, defying the previously anticipated negative outlook that was contingent on maintaining stability below the psychological resistance barrier of 1.3500.

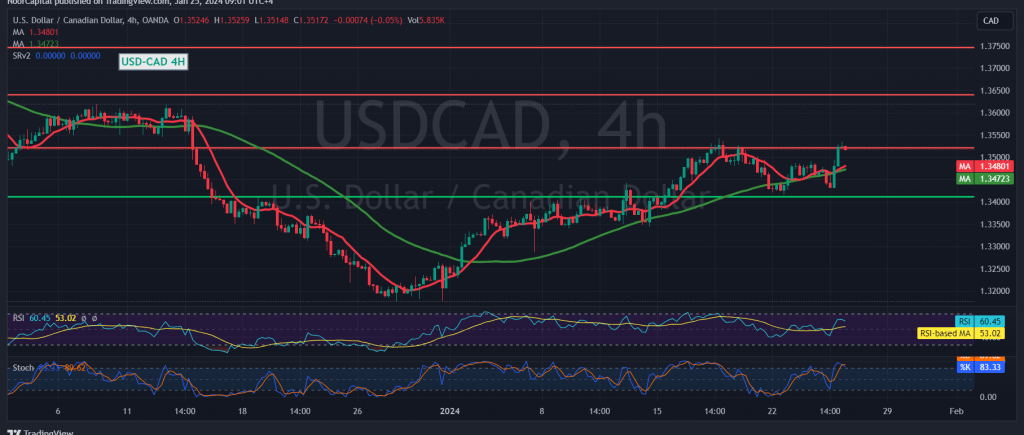

From a technical analysis perspective today, intraday movements of the pair are holding steady above 1.3500, and the support from simple moving averages suggests a potential resumption of the upward trajectory. Positive indications are further corroborated by clear signals on the 14-day momentum indicator.

A bullish trend throughout the day is plausible, targeting 1.3560 as the initial objective. A breach of this level would amplify gains, opening the path directly towards 1.3600 as the next station, unless there is a reversal of trading leading to price stabilization below 1.3450.

A dip below 1.3450 revitalizes the prospects of a return to a downward trend, with a retest of 1.3390 expected before the next price direction becomes apparent.

Investors are cautioned, as today’s market activity is influenced by high-impact economic data from the Eurozone, including the European Central Bank Monetary Policy Committee statement, interest rate announcements, and the press conference by the President of the European Central Bank. Consequently, substantial price fluctuations may occur during the news release period.

Moreover, it is crucial to acknowledge that the current geopolitical tensions elevate the level of risk, potentially resulting in heightened price volatility. Prudent risk management is advised in navigating the market under these conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations