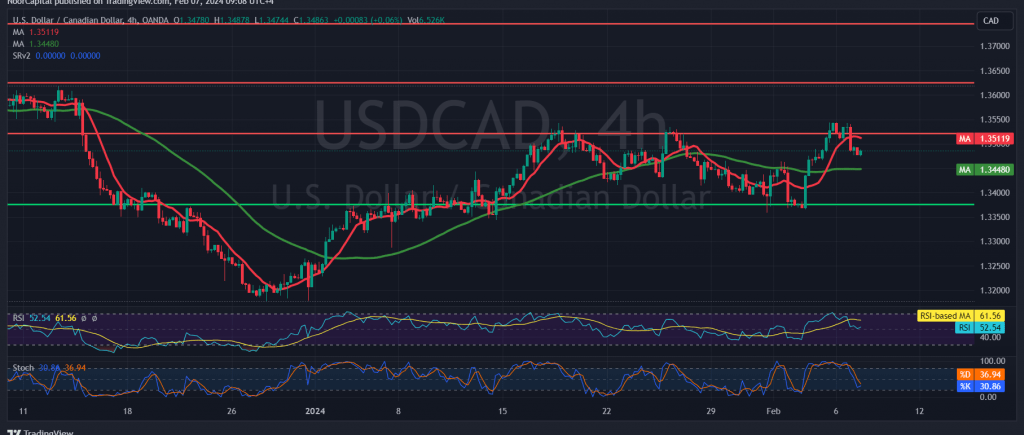

The Canadian dollar has validated the anticipated downward trajectory outlined in our previous technical analysis report, reaching the retest target of 1.3470 as forecasted, with a recorded low of 1.3474 during early morning trading.

Technical Analysis: Bearish Bias Intact

Assessing the technical landscape today, our analysis maintains a bearish stance, emphasizing the significance of intraday stability below critical resistance levels. Specifically, attention is drawn to the psychological barrier at 1.3500 and the formidable resistance at 1.3540. Furthermore, indications of limited upward momentum underscore the prevailing bearish sentiment.

Projected Scenario and Downside Targets

Against this backdrop, we anticipate a continuation of the bearish bias in the upcoming trading sessions. A decisive breach below the support level at 1.3470 would likely pave the way for a retest of 1.3430, followed by a deeper decline towards 1.3385.

Reversal Scenarios and Upside Targets

Conversely, a reversal of fortunes would require a breakout above the resistance at 1.3540. Such a development could signal a shift in market dynamics, potentially leading to a bullish reversal. In this scenario, upside targets may be identified at 1.3600/1.3590.

Conclusion: Navigating Market Dynamics

As the Canadian dollar continues its price journey, traders are advised to remain vigilant and closely monitor key support and resistance levels. Sustained stability below 1.3470 would affirm the bearish bias, offering opportunities for short positions targeting lower support levels. Conversely, a breakout above 1.3540 could signal a reversal, warranting caution and adaptability in trading strategies.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations