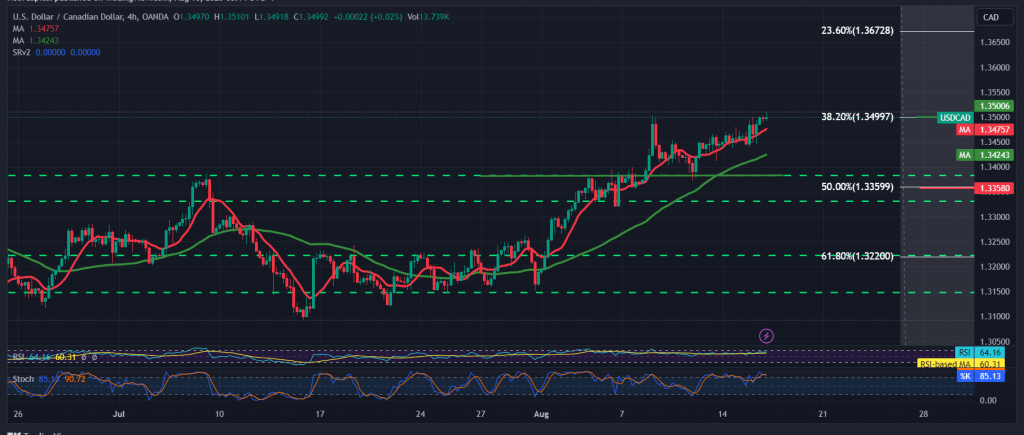

The Canadian dollar jumped within the expected positive technical outlook yesterday, surpassing the first target to be achieved at 1.3500, recording its highest level at 1.3510.

Technically, the 50-day simple moving average still carries the price from below, in addition to the positive signs from the RSI, which is stable above the mid-line.

We tend to rise, provided that we witness a clear and strong breach of the resistance level of the psychological barrier 1.3500, Fibonacci correction of 38.20%, as shown on the chart, to target 1.3530 and 1.35670, respectively, and the gains may extend later towards 1.3600.

It should be noted that confirming a breach of 1.3390 can thwart the bullish scenario, and we are witnessing the beginning of a bearish slope formation, aiming to retest the key support 1.3350, before attempting to rise again.

Note: Today we are awaiting high-impact economic data issued by the US economy, “the results of the Federal Reserve Committee meeting,” and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations