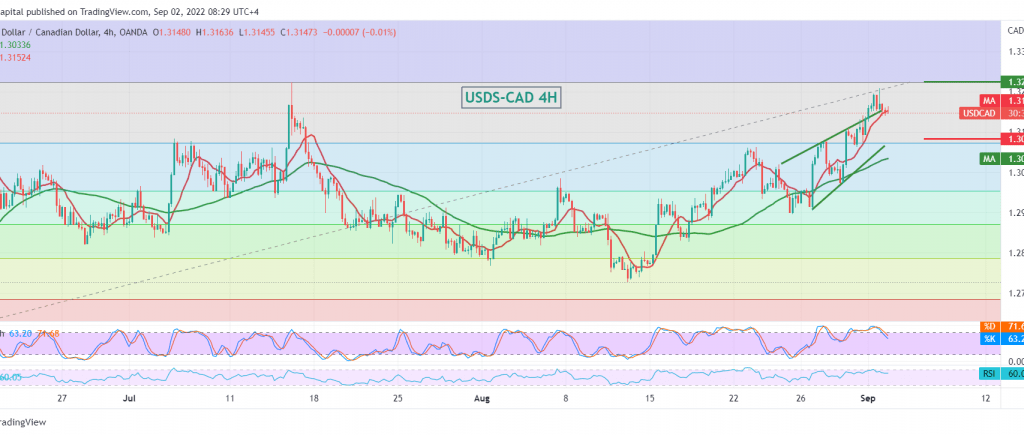

Positive trading continued to dominate the movements of the Canadian dollar during the previous trading session, touching the bullish target required to be touched at 1.3210, recording its highest at 1.3210.

Technically, the current movements are witnessing a bearish tendency after the pair failed to maintain stability for a long time above the 1.3200 level. With careful consideration on the chart, negative features started to appear on the stochastic indicator that may force the pair to provide some negative trades that target retesting 1.3120 and 1 .3080 before attempts to rise again.

Consolidation above 1.3200 will invalidate the mentioned retest idea, and the pair will complete the official bullish path so we will be waiting for 1.3245 and 1.3280.

Note: The US NFP, unemployment rate data and average wages are due for release today in the USA, and they have a big impact, and we may see price fluctuations; all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations