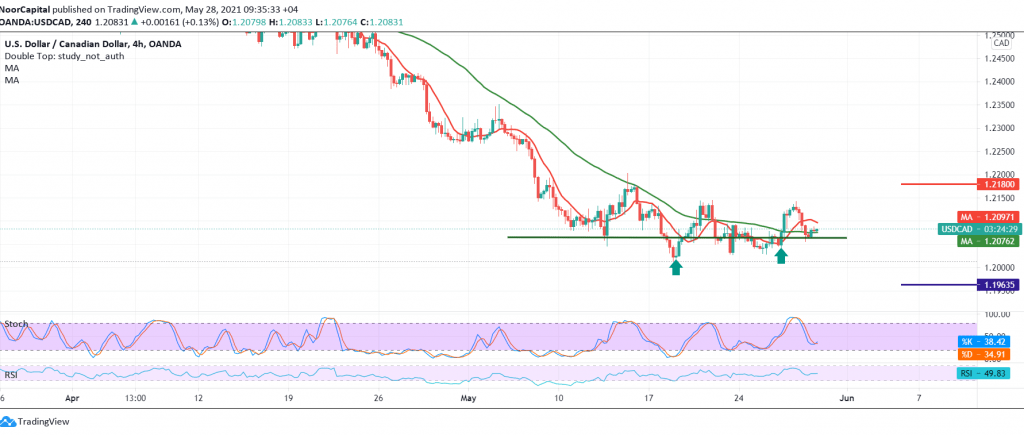

The technical outlook is unchanged, and the movements of the US dollar against the Canadian dollar have not changed significantly within sideways trading from the bottom above 1.2030 and from the top below 1.2130.

Technically, we find the pair succeeded in building a base on the solid support floor 1.2030, as the intraday movements are witnessing stability above the resistance level 1.2070.

The 50-day SMA returned to hold the price from below, accompanied by the RSI’s attempts to obtain additional bullish momentum.

Therefore, a bullish corrective tendency is likely today, provided the current moves remain above 1.2090 targeting 1.2130 first target, knowing that breaching it is a catalyst capable of enhancing the chances of the upside towards 1.2180.

Activating the bullish scenario requires intraday stability above 1.2060, and in general above 1.2030. It should be noted that the return of trading stability below 1.2030 will immediately stop the bullish correctional trend and lead the pair to the official descending path with initial targets starting at 1.2000 and may extend to visit 1.1965.

Note: The level of risk may be high.

| S1: 1.2045 | R1: 1.2130 |

| S2: 1.2000 | R2: 1.2180 |

| S3: 1.1960 | R3: 1.2220 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations