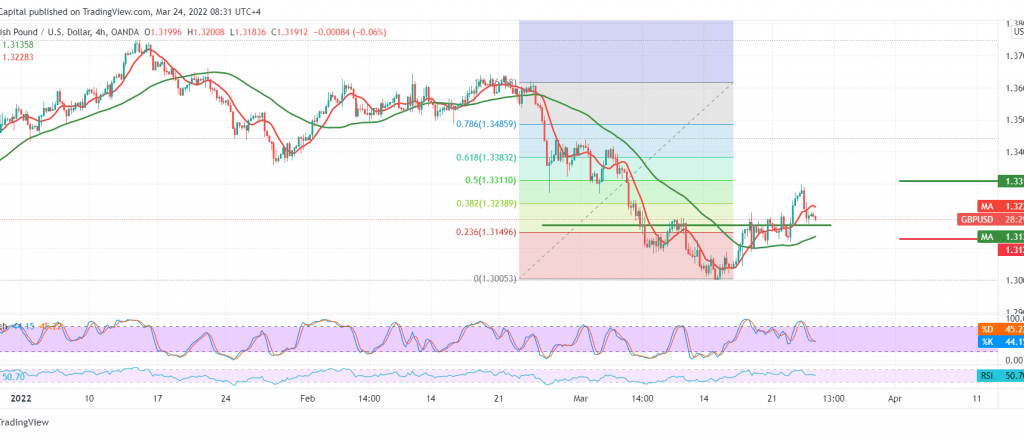

The pair returned the support level of 1.3175 during the last trading session, and the current movements are witnessing stability above the mentioned support level.

Technically, and with careful consideration on the 4-hour chart, we notice the stochastic started to lose the bullish momentum temporarily, and we also find the 50-day moving average pressing on the price, in addition to the stability of the intraday trading below the 1.3240 resistance level.

The possibility of a bearish bias in the coming hours is valid with the aim of retesting 1.3130 and 1.3100 before attempts to rise again, taking into consideration that the effect of the bullish pattern is still valid. It should be noted that consolidation above 1.3240, 38.20% Fibonacci correction, might stop the idea of retesting and lead the pair to the bullish daily track with the first target of 1.3310, 50.0% correction, and price behavior should be monitored well around this level because its breach increases the strength of the bullish trend, opening the door to 1.3350.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3170 | R1: 1.3240 |

| S2: 1.3060 | R2: 1.3310 |

| S3: 1.3000 | R3: 1.3380 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations