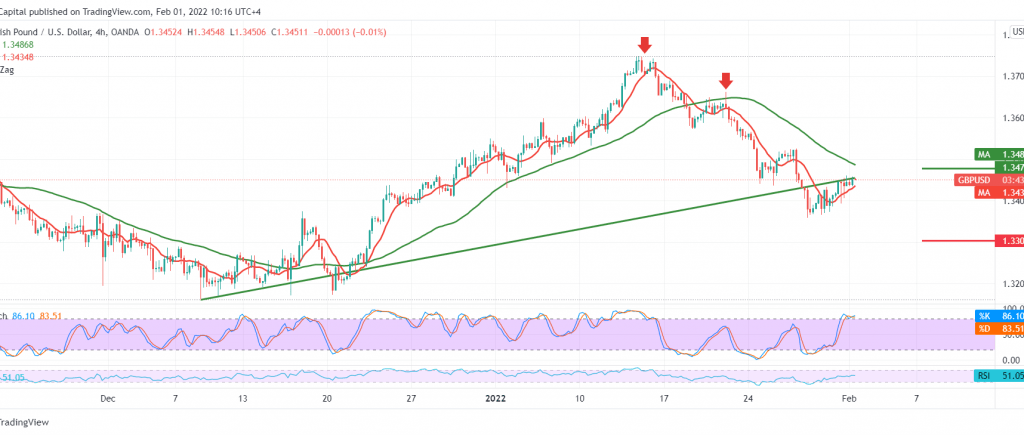

Positive movements dominate the British pound against the US dollar, building on stability above the strong support level at 1.3400. However, the current trading is witnessing attempts to breach the resistance level of 1.3470.

Reading the chart on the 60-minute time frame indicates the possibility of a rise accompanied by clear positive signs on the RSI. However, moving to the 4-hour time frame, we find signs of negativity still dominating the stochastic indicator.

We monitor the price behavior of the pair throughout today’s trading session, knowing that a breach of the resistance level of 1.3480 may support the rise towards 1.510 and 1.3550, respectively. In contrast, the failure to breach 1.3480 and the return of trading stability below 1.3400 leads the pair to the official descending pat. 1.3300 is the waiting station.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3400 | R1: 1.3480 |

| S2: 1.3360 | R2: 1.3510 |

| S3: 1.3300 | R3: 1.3560 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations