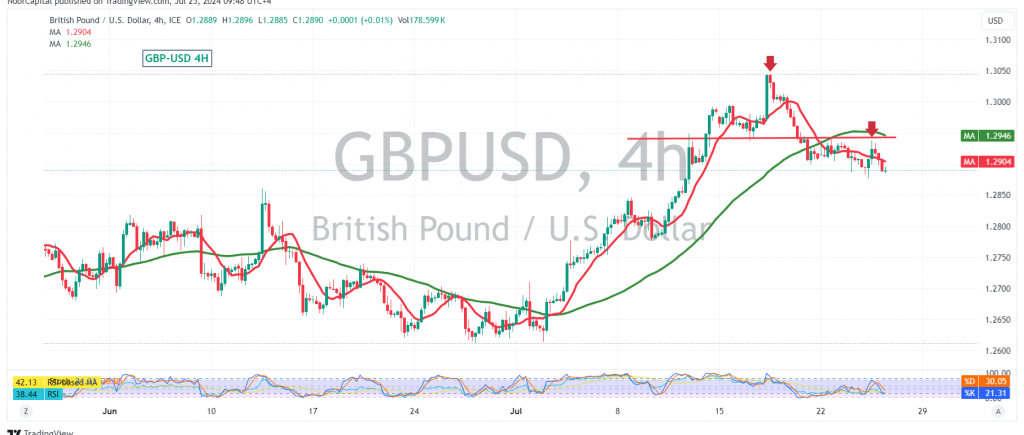

The British pound continues to hold a bearish stance against the US dollar, maintaining pressure on the 1.2890 support level, awaiting a signal to confirm a break.

Technically, the 4-hour chart reveals continued negative signals from the Stochastic indicator, accompanied by the simple moving averages applying downward pressure, along with a bearish technical formation.

Given these factors, there is potential for a bearish movement in today’s trading. A break below 1.2890 could lead to a decline towards 1.2860 and 1.2840, with further losses potentially extending to 1.2800, the next key support level.

Conversely, a break above and consolidation above 1.2950 would invalidate the bearish scenario, potentially leading to a retest of the 1.3000 level.

Warning: Today’s trading session may see high price volatility due to the release of significant economic data from the American economy, including the preliminary GDP reading (quarterly) and weekly unemployment benefits.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations