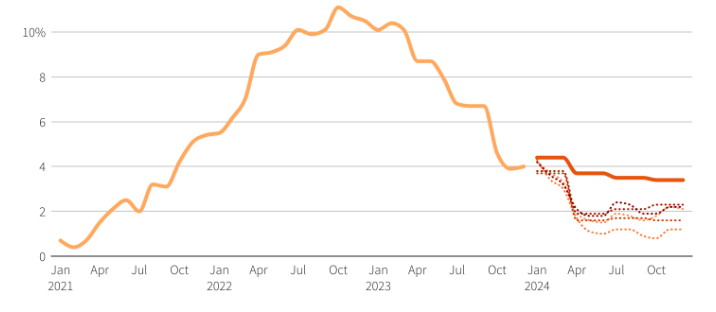

The Bank of England is at a crossroads as it prepares to announce its interest rate decision. Financial markets are abuzz with anticipation, expecting the BoE to start reducing interest rates from the June meeting. Traders have already priced in 53 basis points (bps) of easing this year, implying at least two quarter-point cuts. This shift in expectations came after inflation data last month showed prices slowing by less than expected in March.

Steady Rates, Dovish Outlook

Currently, interest rates in the United Kingdom stand at 5.25%, maintaining their level for the sixth consecutive time. However, there’s a twist. BoE policymakers appear confident that headline inflation could return to the desired rate of 2% in April. BoE Governor Andrew Bailey, speaking at the annual Spring Meeting hosted by the International Monetary Fund (IMF), hinted at this optimistic outlook. If realized, this could signal a slightly dovish stance on interest rates.

GBP/USD Performance

The GBP/USD pair has been navigating a bearish trend. Earlier on Wednesday, it traded at 1.2483, down 0.20%. As of now, it hovers around 1.2498, down only 0.08%. Despite a support trendline at 1.2467, the bearish Relative Strength Index (RSI) suggests ongoing seller pressure. Key resistance levels include the 200-day moving average (DMA) at 1.2543, followed by 1.2594 and the May 3 high of 1.2634 if GBP/USD breaks above 1.2500.

BoE Versus Fed

Governor Bailey’s recent remarks indicate that the BoE may deviate from the Fed’s path of monetary policy. While central bank heads often follow the Fed, the prevailing growth in the US isn’t mirrored globally. The BoE’s February forecast predicted a sharp drop in inflation mid-year, followed by an extended period above the 2% target. Deputy Governor Dave Ramsden, known for his hawkish stance, even suggested a notable chance of inflation remaining at target. However, risks to the inflation outlook favor the downside, impacting GBP/USD alongside gilt yields.

Tomorrow’s Policy Statement

The BoE’s two-day policy meeting concludes tomorrow, with the official statement eagerly awaited. The updated quarterly projections will play a crucial role. If they align with Dave Ramsden’s dovish comments, medium-term inflation could ease toward or hit 2%. Such a scenario poses a downside risk to cable, especially as US-UK policy expectations diverge. Keep an eye on any changes in forward guidance regarding rates “remaining sufficiently restrictive” for an “extended period.” Such adjustments may signal a prelude to a possible rate cut in June.

Market Reaction

The GBP/USD pair has seen fluctuations. While it eased during the early London session, it rebounded after the Europe-US crossover. Currently trading flat for the day, the imminent level of resistance/support lies at 1.2500. A close above this level would be crucial to maintaining bullish momentum.

In summary, the Bank of England’s interest rate decision holds significant implications for the Pound Sterling. As markets await the official statement, all eyes are on the BoE’s projections and any subtle shifts in forward guidance. The Pound’s fate hangs in the balance, influenced by both domestic and global economic dynamics.

The recent UK inflation data has been a key driver behind the Bank of England’s interest rate adjustments. As inflation remains a critical factor, the central bank’s forward guidance and monetary policy outlook will continue to shape the Pound Sterling’s performance in the global currency markets.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations