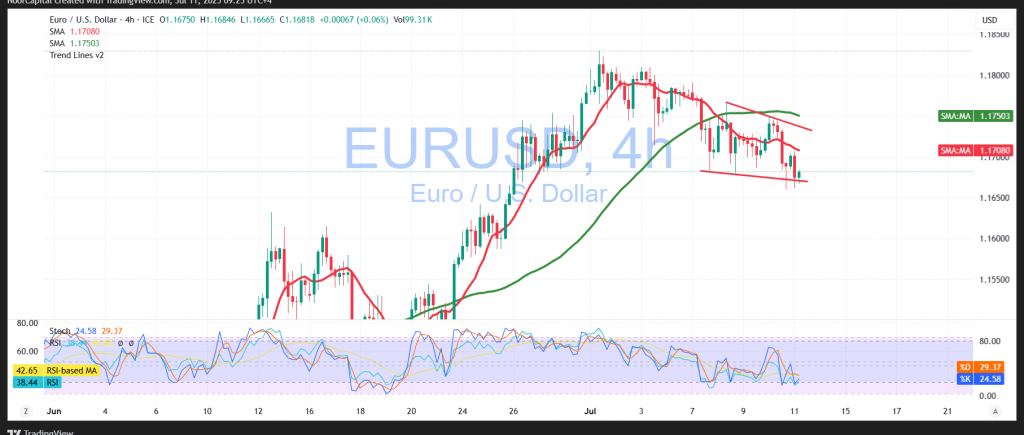

The EUR/USD pair experienced bearish pressure in the previous trading session, testing key support levels and dropping as low as 1.1662.

Technical Outlook – 4-Hour Timeframe:

The pair is currently trading below the 1.1730 resistance level, with the simple moving averages preventing any upward movement. The Relative Strength Index (RSI) also shows weak signs, adding to the bearish sentiment despite the pair’s oversold condition.

Probable Trend:

As long as the price remains below 1.1730, the likelihood of a continuation of the downward corrective movement is high. A break below the 1.1660 support level would confirm this bearish trend, potentially targeting 1.1645 as the next support level, followed by 1.1600.

However, if the price breaks above 1.1730 and holds above it, a potential bullish reversal could emerge. This would open the possibility for further gains, with the next technical target at 1.1785.

Risk Warning:

Please be aware that risk is high amid ongoing trade tensions, and all scenarios remain possible. Market volatility can amplify the potential for sudden changes in direction.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations