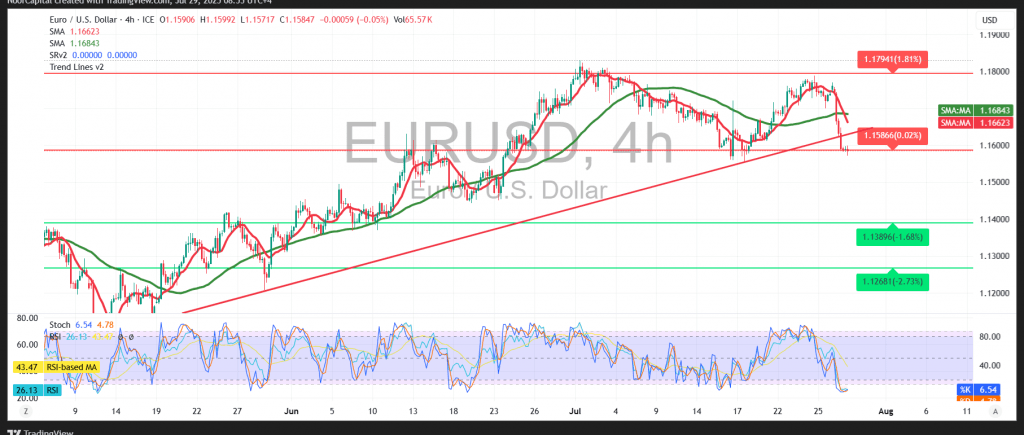

The EUR/USD pair experienced a notable decline at the start of this week’s trading, driven by strength in the US dollar, with the pair reaching a low of 1.1574.

Technical Outlook:

Currently, the pair is trading within a narrow range around 1.1580. A closer look at the 4-hour chart reveals subtle bullish signals from the Relative Strength Index (RSI), with a potential positive crossover suggesting limited short-term recovery attempts.

However, the 50-period Simple Moving Average (SMA) continues to act as dynamic resistance, exerting downward pressure on the price. This aligns with a confirmed break below the ascending trendline, further reinforcing the overall bearish technical outlook.

Likely Scenario:

As long as the pair remains below the resistance level of 1.1710, the bearish bias is expected to persist. A break below the 1.1570 support could pave the way for further losses toward the next key levels at 1.1510, followed by 1.1445.

On the other hand, a clear break above the 1.1710 resistance and sustained trading above it may trigger a corrective bullish move, with potential upside towards the 1.1810 level.

Caution: The market remains highly volatile amid ongoing trade tensions. Traders should be prepared for sharp moves in either direction.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations