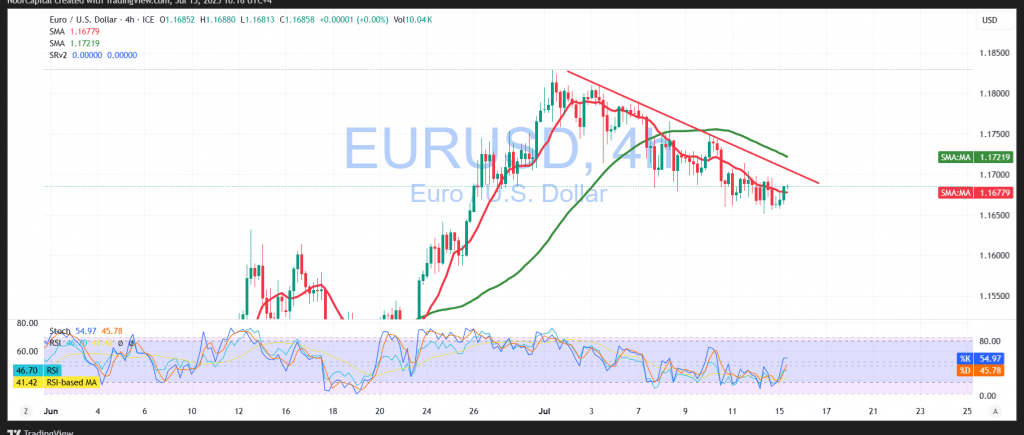

A bearish trend continues to dominate EUR/USD price action, with the pair approaching the psychological resistance level at 1.1700, which has triggered renewed negative intraday movement.

Technical Outlook – 4-Hour Timeframe:

The pair is currently trading below the initial resistance at 1.1685, with the simple moving averages acting as dynamic barriers to any upside attempts. While the Relative Strength Index (RSI) is showing signs of oversold conditions, its weakness continues to weigh on momentum. Price action also remains capped below the 50-period simple moving average, reinforcing the prevailing bearish pressure.

Preferred Scenario – Bearish Bias:

As long as the pair remains below 1.1730, the outlook favors a continuation of the corrective downtrend. A confirmed break below the 1.1650 support level would strengthen this view, potentially opening the door for a decline toward 1.1610 as the next target.

Alternative Scenario – Bullish Reversal:

Should the pair break and sustain trading above 1.1730, it may signal a potential bullish reversal, with upside targets at 1.1760, followed by 1.1785.

Market Catalyst:

Traders should remain cautious ahead of the release of high-impact U.S. economic data, including monthly and annual Core Consumer Price Index (CPI) figures. These releases may trigger significant market volatility.

Caution:

Risk remains elevated amid ongoing global trade tensions. All scenarios are possible, and proper risk management is strongly advised.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations