US crude oil futures extended their losses during the European trading session, reaching the first official target of $69.00 and recording a low of $68.85 per barrel.

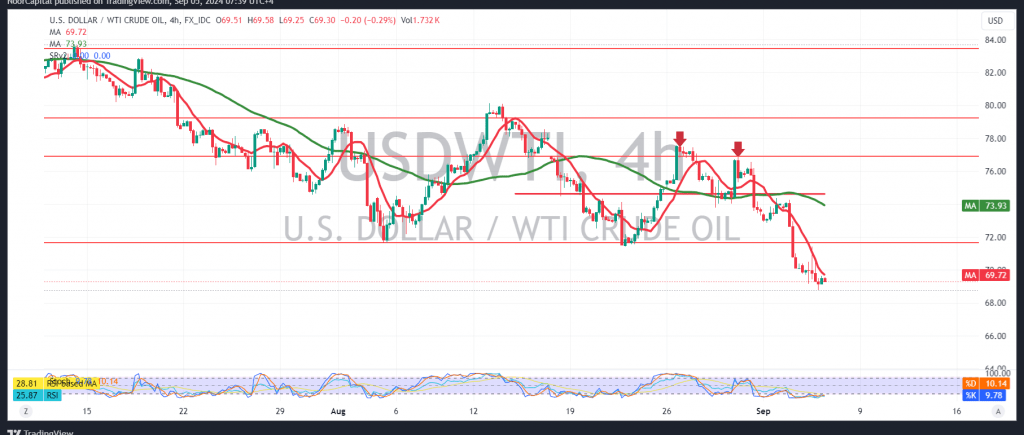

From a technical perspective, oil found solid support near $69.00, leading to some temporary gains. However, a closer look at the 4-hour chart shows that the simple moving averages are still negatively aligned, reinforcing the downward trend. Additionally, daily trading remains below the key resistance levels of $70.85 and $74.40.

As a result, the bearish scenario remains the most likely. A confirmed break below $68.85 would pave the way for further declines, targeting $68.30 and potentially $67.30, the next official support levels.

On the flip side, if prices manage to consolidate above $71.40, we may see a temporary recovery, with potential gains toward $72.45 and possibly extending to $73.40.

Warning: The risk level is high.

Alert: High-impact economic data from the U.S., including “Non-farm private sector jobs data,” weekly unemployment claims, and the ISM Services PMI, could introduce significant volatility today.

Warning: Geopolitical tensions remain elevated, and price volatility could be significant.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations