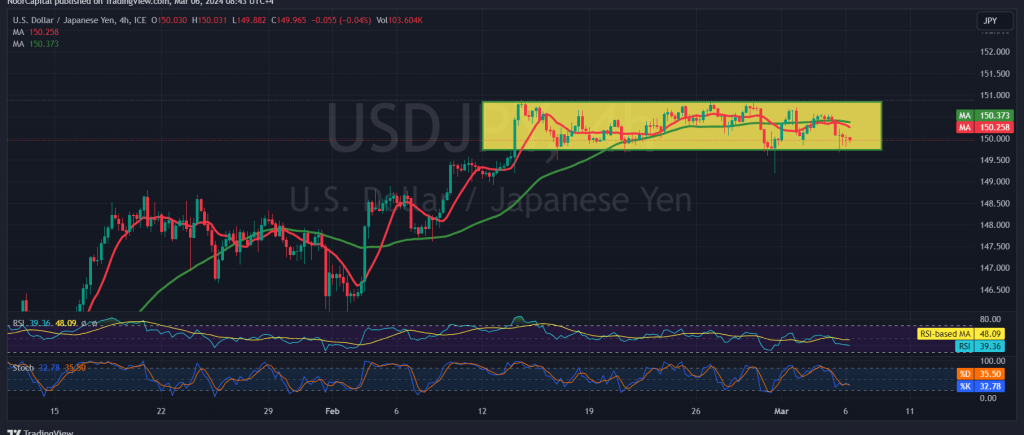

We maintained a neutral stance in the previous technical report due to conflicting signals and the pair’s trading range between 150.80 and 149.70.

Today, we observed that the support level at 149.70 held firm, with the pair reaching its lowest point at this level. Breaching below 149.70 could signal the start of a downward trend. However, upon closer examination of the 4-hour chart, the pair remains stable above this support, suggesting a positive bias. Despite this, the simple moving averages continue to exert downward pressure, along with intraday trading remaining below 150.50 and, generally, below 150.80, supporting a negative outlook.

Given the mixed signals and the pair’s trading range, we opt to monitor its behavior for potential scenarios:

- For an upward trend, a clear break above the 150.80 resistance is needed. This could lead to further gains towards 151.25 and 151.70. Conversely,

- Breaching below 149.70 would indicate a downward path, with initial targets around 149.10 and 148.80.

Warning: High-impact economic data releases from the US and Canada, including changes in private non-agricultural sector jobs, job vacancies, and the labor turnover rate, along with testimony from the Federal Reserve Governor, may cause increased volatility.

Exercise caution and closely monitor price movements during these events.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations