US crude oil futures prices experienced a significant decline, relinquishing earlier gains and confirming the bearish outlook outlined in yesterday’s analysis. The prices touched the initial target of $77.70, reaching a low of $77.55 per barrel.

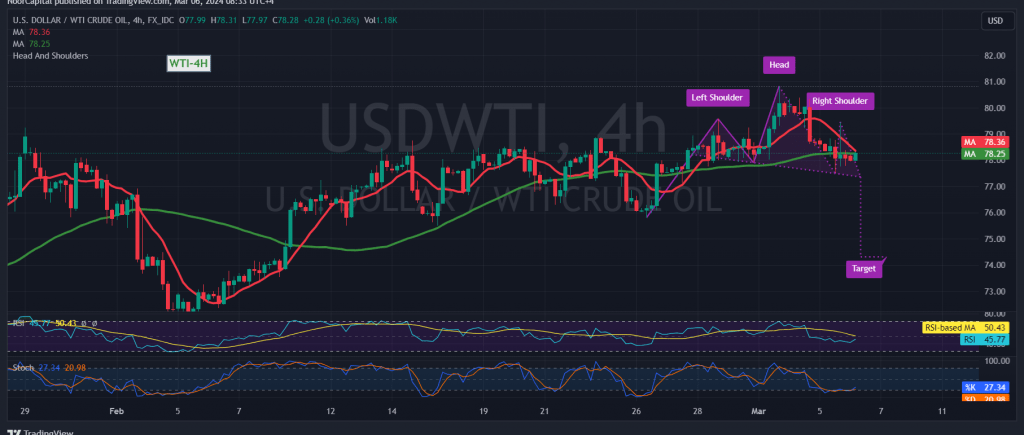

Upon closer examination of the 4-hour chart, it is evident that the price remains stable below the resistance level of $78.50. Additionally, the simple moving averages continue to exert downward pressure on the price, complemented by a bearish technical formation observed on the chart.

Our bias leans towards negativity, albeit with caution, contingent upon a break below the $77.50 level. Such a development could pave the way for a visit to $76.50 and $75.60, respectively. It is imperative to note that the realization of this scenario hinges on sustained trading below $78.50. Conversely, a breach of this level could invalidate the downward momentum, potentially initiating an upward wave with initial targets at $79.30 and $80.30.

Warning: High-impact economic data releases are anticipated from the American and Canadian economies today, including changes in private non-agricultural sector jobs, job vacancies, and the labor turnover rate, along with testimony from the Federal Reserve Governor. Expect heightened volatility during these events.

Warning: Geopolitical tensions persist, contributing to the overall risk factor and potential for increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations