The Canadian dollar performed in line with our expectations during the previous trading session, achieving the first target at $1.3590 and reaching a peak of $1.3606.

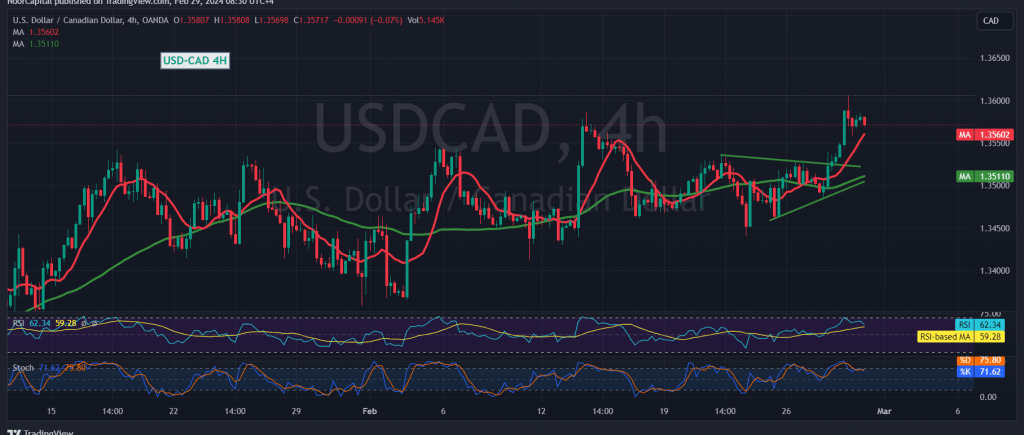

In today’s technical analysis, observing the 4-hour timeframe chart, we note that the pair’s intraday movements are currently stabilized below the psychological barrier resistance of $1.3600. Additionally, the Stochastic indicator indicates a gradual loss of bullish momentum.

There is a possibility of a bearish trend emerging in the upcoming hours, with the potential to retest support levels at $1.3530 and $1.3500, respectively. It’s worth noting that such a retesting scenario does not contradict the overall upward trend. The official targets for the upward trend are around $1.3650 and $1.3680, particularly upon breaching the $1.3610 level.

A word of caution: Today’s trading activity may experience heightened volatility due to the impending release of high-impact economic data from the American economy, including the annual and monthly basic personal consumption spending prices, along with the weekly unemployment benefits. Traders should be prepared for potential market fluctuations during this period.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations