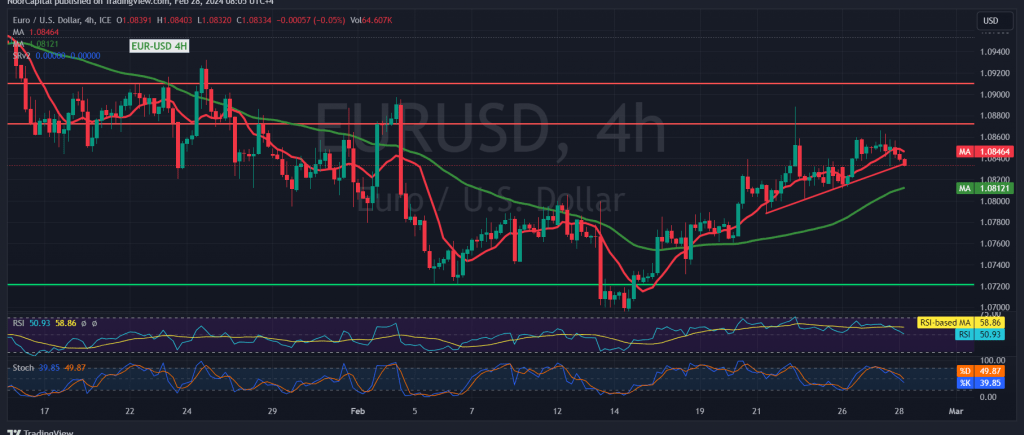

The EUR/USD pair continues to experience narrow sideways trading for the third consecutive session, maintaining a range between the main support level of 1.0765 and the pivotal resistance of 1.0860.

From a technical perspective today, upon analysis of the 4-hour timeframe chart, the 50-day simple moving average persists in guiding the price from below, coinciding near the psychological barrier of 1.0800, thereby reinforcing its significance. Conversely, negative signals from the Stochastic indicator persist, indicating a continued loss of upward momentum.

Given the conflicting technical signals and the pair’s entrapment between the aforementioned levels, it is prudent to monitor the pair’s price action to ascertain one of the following scenarios:

- A clear and robust breach of the resistance level at 1.0860 is imperative to establish an upward trend, facilitating potential gains towards 1.0930 and 1.0960, which are the awaited stations for bullish momentum.

- Conversely, a downward trend signal hinges upon breaking below 1.0800 and subsequently 1.0765. Such a breach would subject the pair to negative pressure, with downside targets commencing at 1.0740 and potentially extending to 1.0665.

A word of caution: Today’s trading environment is marked by the impending release of high-impact economic data from the American economy, specifically the preliminary reading of the gross domestic product – quarterly. Consequently, heightened volatility is anticipated at the time of the news release.

A word of caution: Today’s trading landscape is punctuated by the release of impactful economic data emanating from the American economy, notably the “Consumer Confidence Index.” Consequently, heightened volatility is anticipated upon the dissemination of this news.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations