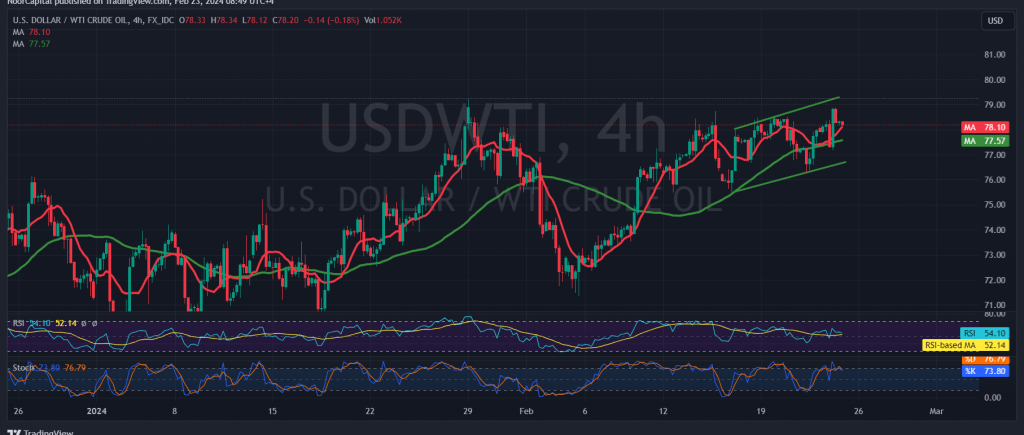

The US crude oil futures contracts have continued their upward trajectory, in line with the bullish forecast outlined in the previous technical report, reaching the initial target at $78.60 and peaking at $78.88 per barrel.

From a technical standpoint, the prevailing sentiment remains positive, supported by the ongoing influence of the 50-day simple moving average and favorable signals from the 14-day momentum indicator on shorter timeframes.

With the price demonstrating stability above the support level of $77.40, confidence in maintaining a bullish outlook is reinforced. Initial targets are set at $79.00, with a potential breach signaling further upward momentum towards $79.75. Subsequent gains could extend towards the $80.00 mark.

It’s important to note that a return to trading stability below $77.35 would invalidate the bullish scenario, exposing the price to significant downward pressure, with an initial target at $76.50.

Warning: The Stochastic indicator is in the process of eliminating current negative signals, suggesting potential price fluctuations until a clear direction is established.

Warning: Given the ongoing geopolitical tensions, there’s a possibility of heightened price volatility, contributing to increased risk levels. Traders should exercise caution and implement appropriate risk management strategies.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations