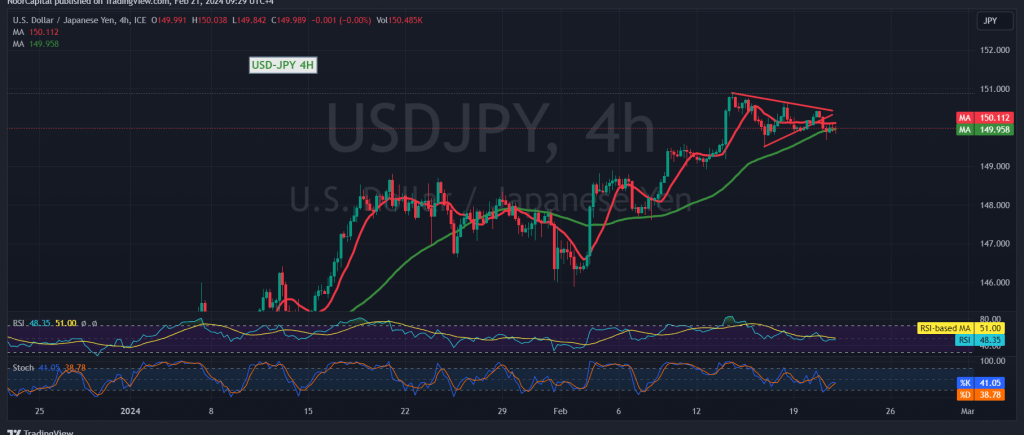

Negative trading has regained control over the movements of the USD/JPY pair, reversing the bullish scenario outlined in the previous technical report. The pair failed to sustain trading levels above the psychological barrier support of 150.00, leading to a shift in sentiment.

Technical Analysis Insights:

A closer examination of the 4-hour chart reveals the pair’s susceptibility to negativity, evident in the Stochastic indicator’s downward trend and waning upward momentum. Additionally, the 14-day momentum indicator signals clear bearish sentiment.

Preferred Bearish Bias:

Given the prevailing conditions, a bearish bias is favored for today’s trading session, particularly if trading remains below the 150.40 level. The target for downside movement is set at 149.65, representing an anticipated official target. Further losses may occur upon breaching this level, potentially leading to a downward trajectory towards 149.30, as long as prices remain below 150.40.

Risk Advisory:

Traders should be cautious as the risk level remains elevated, and market conditions may be subject to volatility.

Upcoming Events and Caution:

High-impact economic data is anticipated from the American economy, particularly the results of the Federal Reserve Committee meeting. Traders should brace for potential price fluctuations around the time of these news releases.

Conclusion:

The USD/JPY pair experiences negative momentum, prompting a bearish outlook for today’s trading session. Traders are advised to exercise caution and remain vigilant, especially given the potential market volatility associated with upcoming economic events.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations