In the pulse of the financial world, the spotlight of the past week fell squarely on key US economic indicators, particularly inflation data, igniting a flurry of activity and recalibration across markets.

Inflation Insights

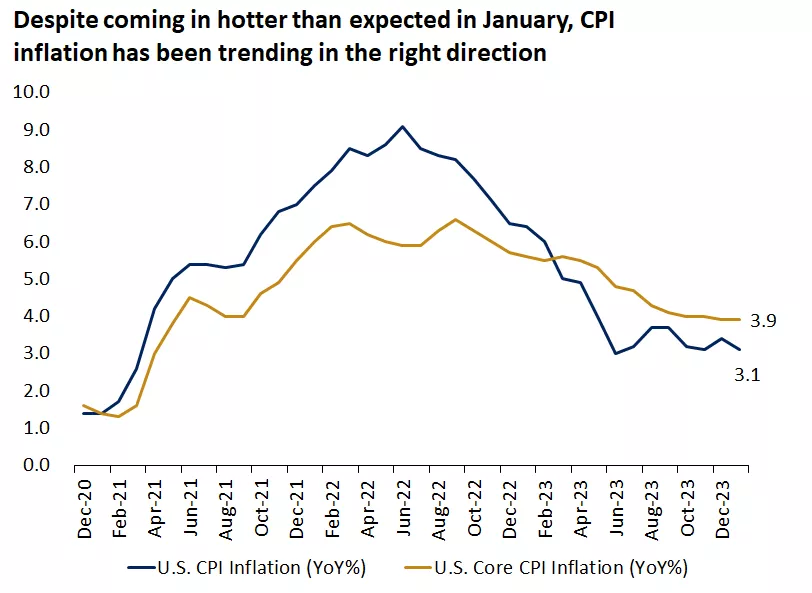

Headline US inflation for January came in at 3.1%, a modest improvement that fell slightly short of market expectations. This figure, coupled with the core inflation rate of 3.9% on an annual basis, excluding volatile food and energy prices, underscored the ongoing battle to reach the Federal Reserve’s targeted 2% inflation mark.

Market Response

Anticipation of a potential interest rate cut by the US Federal Reserve in May faced a recalibration in light of these figures. Futures traders, reacting to the data, revised down the probability of a rate cut from 50% to 30%. Fed Chair Jerome Powell’s emphasis on achieving the targeted inflation rate before considering any easing measures further shaped market sentiment.

The US market, in a spirited response, witnessed the dollar index surging to a three-month high of 104.7, fueled by the unexpected strength in inflation metrics. Market dynamics swiftly discounted any near-term interest rate hikes, with the likelihood of a March increase being ruled out and prospects for a May hike estimated at a modest third. A June lift, meanwhile, appears increasingly inevitable.

US stock futures experienced a notable downturn, while government bond yields, particularly the two-year Treasury note, surged by 0.15 percentage point to 4.62%, reflecting the evolving interest rate expectations.

However, amidst these nuanced market movements, US retail sales figures provided a counter-narrative. January saw a 0.8% decline in retail sales, totaling $700.3 billion, a figure below market projections which had anticipated a marginal decrease of 0.1%. Even excluding automobile sales, the decline persisted, with retail sales dipping by 0.6%.

The economic data barrage continued with the US Producer Price Index, which defied expectations by rising 0.3% in January, a marked shift from the preceding month’s decline of -0.1%. This uptick surpassed market forecasts of a 0.1% increase, further adding layers to the intricate tapestry of market sentiment.

As the financial landscape absorbs and reacts to these data points, investors and analysts alike remain poised for further insights into the trajectory of the US economy. With inflation dynamics at the forefront, the evolving narrative of interest rate adjustments and consumer behavior will undoubtedly shape the weeks ahead, offering both challenges and opportunities for market participants.

UK Economic Growth Contracts, Pound Wavers

In a quarter marked by challenges, the UK’s economic growth faced a setback, contracting by 0.3% quarter-on-quarter in the final months of 2023, a steeper decline compared to the previous quarter’s 0.1% contraction. Contrary to market consensus, which anticipated a milder contraction of -0.1%, the reality painted a more somber picture.

On an annual basis, UK GDP slipped by 0.2% in the fourth quarter, diverging from the 0.1% growth anticipated, and marking a decline from the previous quarter’s 0.3% growth.

Despite the quarterly dip, December offered a glimmer of hope with a 0.1% month-on-month contraction, defying expectations of a steeper decline of -0.2%. However, the Services Index for the same period remained subdued at -0.2% quarter-on-quarter, echoing previous trends.

On a brighter note, December witnessed a boost in industrial production and manufacturing output, rising by 0.6% and 0.8% respectively, offering a silver lining amidst broader economic challenges.

In response to the GDP report, British Finance Minister Jeremy Hunt acknowledged the subdued growth, stating, “Low growth is not a surprise.” However, he expressed optimism, noting signs of a potential turnaround in the British economy while hinting at a cautious approach to monetary policy adjustments.

The market reaction was palpable as the British pound edged slightly lower towards the $1.25 threshold, reflecting investor concerns over the economic trajectory and its implications for the Bank of England’s monetary policy decisions. At the time of reporting, the GBP/USD pair dipped by 0.16%, settling at $1.2546.

European Union Faces Growth Headwinds

Meanwhile, across the English Channel, the European Union grappled with its own economic challenges as the European Commission revised down growth expectations for 2024 by 0.4 percentage points to 0.8% in the eurozone. Despite narrowly avoiding a technical recession in the latter half of 2023, the outlook for the first quarter of 2024 remains fragile, as highlighted in the Winter Economic Outlook 2024.

While all Eurozone countries are projected to experience growth in 2024, the pace varies, with the German economy expected to expand by 0.3%, the French economy by 0.9%, and the Italian economy by 0.7%.

Additionally, inflation expectations witnessed a downward revision compared to previous forecasts, with headline inflation projected to decline to 2.7% in 2024 from 3.2% in 2023, and further to 2.2% in 2025. This revision reflects the sharp decline in energy prices, outpacing broader expectations and alleviating price pressures.

As energy supplies continue to outpace demand, the decline in spot and futures prices for oil, particularly gas, has surpassed earlier projections, contributing to a recalibration of economic forecasts.

Despite these challenges, the eurozone economy demonstrated resilience, posting a growth of 0.5% in 2023, albeit moderating from the robust 3.4% growth observed in 2022.

Bitcoin Surges Past $1 Trillion Market Cap Milestone

In a historic milestone, the total market value of Bitcoin surged past the $1 trillion mark on Wednesday, marking a significant resurgence since late 2021, according to data from CoinMarketCap. Simultaneously, the digital currency soared above $51,000, reaching its highest price point since December 2021.

As of 6:15 a.m. ET, Bitcoin breached the $51,229 level, marking an impressive nearly 3% increase from its price just 24 hours prior, as reported by CoinDesk data.

This remarkable ascent is part of a sustained upward trend that commenced in January of the previous year. Year-to-date, Bitcoin’s price has soared by over 21%, reflecting its enduring appeal among investors seeking alternative assets.

However, Thursday’s trading session witnessed a slight dip in Bitcoin’s price, shedding approximately $350 per unit after surpassing the $52,000 barrier, a threshold not breached since late 2021. Bitcoin retreated to $51,574 per unit, compared to the previous daily close of $51,844. The cryptocurrency oscillated between highs of $51,364 and lows of $52,884, indicative of the market’s ongoing volatility.

This upward trajectory mirrors previous patterns observed during “Bitcoin halving” events, a technical process characterized by the reduction of mining rewards in Bitcoin. This reduction diminishes the cryptocurrency’s supply in the market, consequently bolstering its price. With the next “Bitcoin halving” anticipated within two months, investors are eyeing potential price surges in anticipation of this event, a trend seen in preceding halving cycles.

Looking Ahead: Key Market Events

In the upcoming week, investor focus will pivot towards several pivotal events that promise to shape market sentiment. Foremost among these is the release of the Federal Open Market Committee (FOMC) meeting minutes, offering valuable insights into the Federal Reserve’s stance on interest rate cuts, a topic of keen interest for traders.

Additionally, preliminary global purchasing managers’ indices (PMIs), including the S&P Global US PMIs, will provide crucial assessments of economic performance this month, serving as barometers for market sentiment.

Beyond the US, attention will extend to PMIs for major economies such as the Eurozone, Germany, France, the UK, Japan, and India. Furthermore, investors will closely monitor key indicators such as the Ifo business climate index in Germany, the interest rate decision in Turkey, and the inflation rate in Canada, all of which are poised to influence market dynamics in the coming days.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations