Euro/Dollar Pair Navigates Quiet Trading Session with a Positive Bias

In the previous trading session, the Euro/Dollar pair demonstrated a subdued yet favorable trajectory, aligning with the anticipated bullish momentum. Notably, the Euro commenced its advance towards the critical 1.0780 resistance level, indicating a potential breakthrough on the horizon.

Establishing Support and Momentum Signals

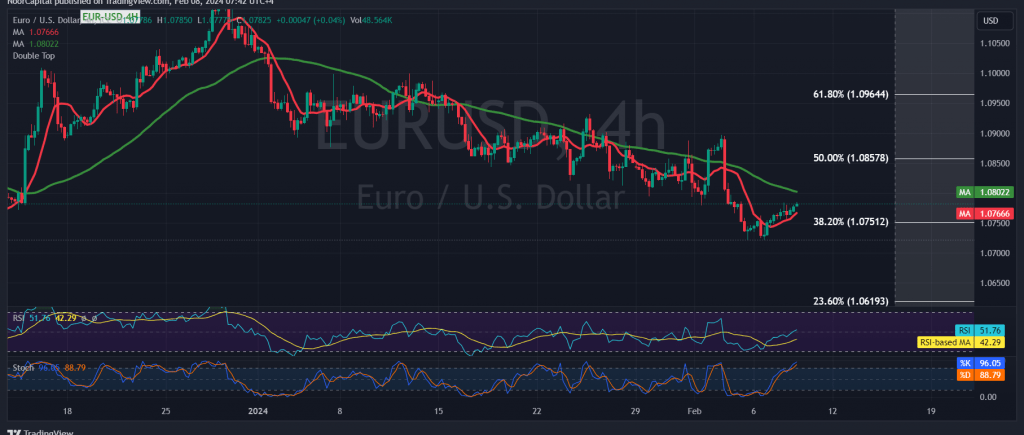

A detailed examination of the 4-hour timeframe chart reveals the pair’s successful establishment of a robust support base around 1.0715. This development is further bolstered by the Stochastic indicator, which exhibits promising attempts to generate additional momentum signals, potentially propelling the pair higher.

Maintaining a Positive Outlook with Caution

While our stance leans towards optimism, a cautious approach is warranted. Sustained price consolidation and stability above the pivotal 1.0780 mark are imperative. Such stability paves the way for a retest of key resistance levels at 1.0820 and 1.0860, marked by the 50.0% Fibonacci retracement.

Navigating Contrasting Trends

It’s essential to note that the current upward trajectory doesn’t preclude the possibility of a downward trend. Failure to breach the 1.0785 barrier could redirect the pair’s trajectory towards bearish territory. The primary bearish targets stand at 1.0715 and 1.0685, with potential extensions downwards, reaching 1.0645 in subsequent movements.

By integrating these technical insights and maintaining vigilance over critical levels, traders can navigate the Euro/Dollar pair’s fluctuations effectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations