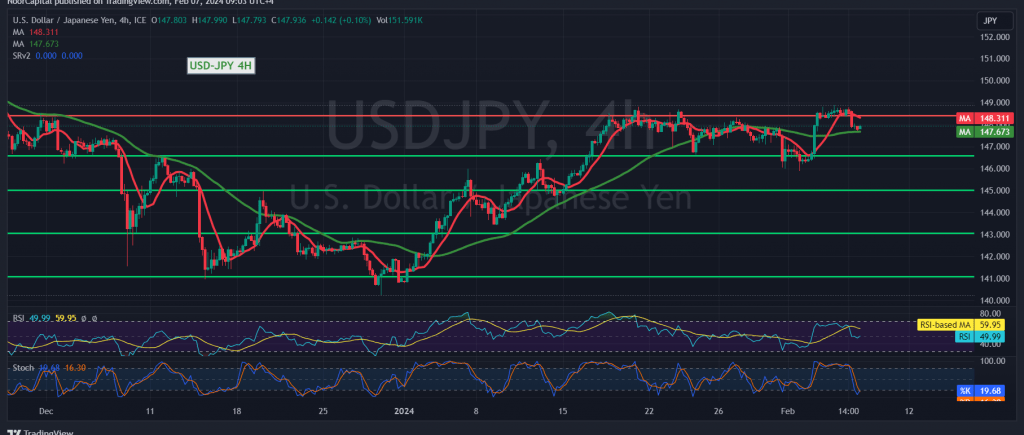

The USD/JPY pair encountered formidable resistance near the 148.85 level, failing to breach it as outlined in our previous analysis. This resistance acted as a significant barrier, prompting a reversal in price action and initiating a bearish trajectory.

Technical Analysis: Bearish Momentum Intensifies

Examining the 4-hour timeframe chart, we observe a clear breakdown below the key support level at 148.30. Furthermore, the emergence of downward pressure is evidenced by the simple moving averages exerting pressure from above, signaling a strengthening bearish bias.

Projected Scenario and Downside Targets

In light of the prevailing technical indicators, a bearish bias is anticipated in the current trading session. The pair is likely to target the initial downside objective at 147.50, followed by a subsequent decline towards 147.10.

Reversal Scenarios and Upside Targets

However, traders should remain alert for potential reversal signals. A decisive breakout above the pivotal resistance level of 148.80 would invalidate the bearish scenario, paving the way for a bullish recovery. In such a scenario, the pair may aim for upside targets at 149.20 and 149.65.

Conclusion: Vigilance Amidst Shifting Dynamics

As the USD/JPY pair navigates its current price action, traders are advised to exercise caution and closely monitor key support and resistance levels. Sustained stability below 148.30 would reinforce the bearish bias, offering potential opportunities for short positions targeting lower support levels. Conversely, a breakout above 148.80 may signal a reversal, necessitating vigilance for potential bullish signals.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations