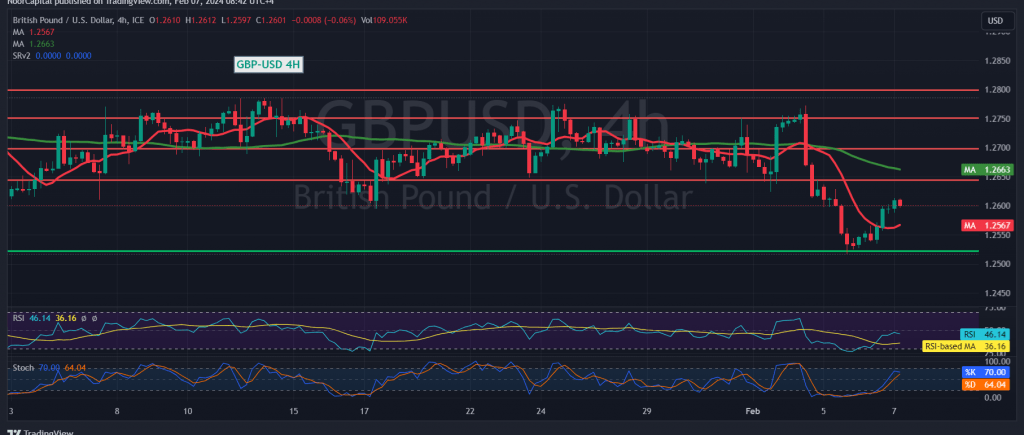

The downward trajectory of the pound sterling against the US dollar continued, with the currency pair experiencing a gradual decline toward the crucial support level of 1.2500, ultimately reaching its lowest point at 1.2530.

Technical Analysis: Bearish Bias Intact

In today’s technical analysis, the prevailing sentiment remains tilted towards negativity. Our analysis emphasizes the significance of trading stability below the critical resistance-turned-support level at 1.2630, coupled with the persistent presence of the 50-day simple moving average acting as a barrier near the psychological resistance level of 1.2600.

Projected Scenario and Targets

Given the prevailing technical landscape, the bearish scenario retains its dominance, with downward pressure likely to persist. The immediate downside target rests at 1.2550, and a breach of this level would potentially trigger further losses, paving the way for a descent towards 1.2500 and subsequently 1.2465.

Potential Reversal Scenarios

However, traders should remain vigilant for potential reversals. A decisive breakout above the resistance-turned-support level of 1.2660 could temporarily halt the bearish momentum, prompting a recovery phase towards the pivotal resistance level at 1.2730.

Conclusion: Monitoring Key Levels for Trading Opportunities

As the GBP/USD pair navigates its downward trajectory, traders are advised to monitor key support and resistance levels diligently. Sustained stability below 1.2630 would reinforce the bearish bias, offering potential opportunities for short positions targeting lower support levels. Conversely, a breakout above 1.2660 may signal a temporary reversal, warranting cautious observation for potential bullish signals.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations