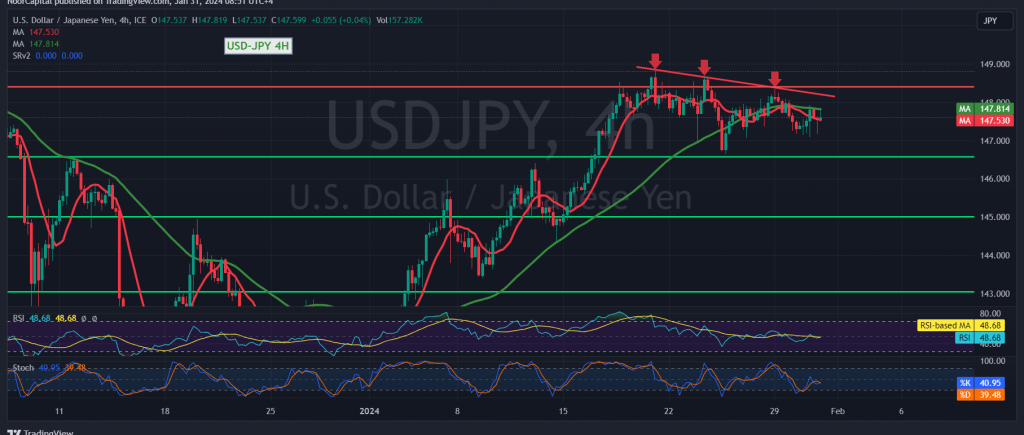

The USD/JPY pair has demonstrated resilience in avoiding a break below the previously highlighted support level at 147.20, a critical point signaling a potential downward trend.

Analyzing the 4-hour time frame chart, the 50-day simple moving average exerts downward pressure from above, converging around the 147.80 resistance level. This convergence, coupled with clear negative signals on the relative strength index, adds strength to the resistance.

There’s a plausible scenario for a bearish trend in the coming hours, contingent upon a break of 147.20. Such a development could pave the way for a visit to 146.70 as the initial target, with potential further losses extending towards 146.40.

Conversely, an upward breakthrough with consolidation above the psychological barrier resistance level of 148.00 would promptly negate the possibility of a decline. The pair could then resume its official upward trajectory, with targets set at 148.40 and 148.80, respectively.

Cautionary Notes:

- Today, high-impact economic data is expected from the American economy, including changes in private non-agricultural sector jobs, the interest rate, the Federal Reserve Committee statement, and the press conference of the Chairman of the Federal Reserve. Expect sharp price fluctuations during the news release.

- The risk level may be elevated.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations