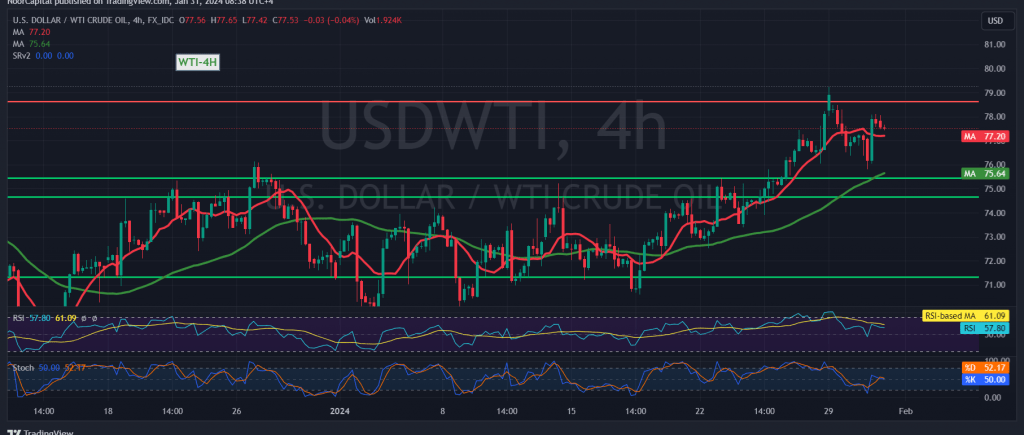

Yesterday, positive movements dominated US crude oil futures contracts, aligning with the anticipated bullish context and reaching a peak at $78.11 per barrel.

From a technical perspective, the upward momentum faced resistance at the psychological barrier of $78.00, leading to a temporary downward bias. A closer examination reveals that the 50-day simple moving average continues to support the price from below, indicating the potential for a resumption of the upward trend. Additionally, the 14-day Momentum indicator shows signs of providing positive signals.

Our outlook remains positive, contingent on oil maintaining stability above $76.00. Notably, a decisive leap and consolidation above $78.00 would strengthen the bullish scenario, paving the way for a potential visit to $78.45 and then $79.40, representing the next main target.

It’s crucial to highlight that a failure to consolidate above $76.00 would immediately negate the proposed bullish scenario, leading to a negative trading session with initial targets at $75.00.

Cautionary Notes:

- The Stochastic indicator is currently negative.

- Today, we anticipate the release of high-impact economic data from the American economy, including changes in private non-agricultural sector jobs, the interest rate, the Federal Reserve Committee statement, and the press conference of the Chairman of the Federal Reserve. Sharp price fluctuations are likely during the news release.

- The level of risk may be elevated amid ongoing geopolitical tensions, potentially resulting in high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations