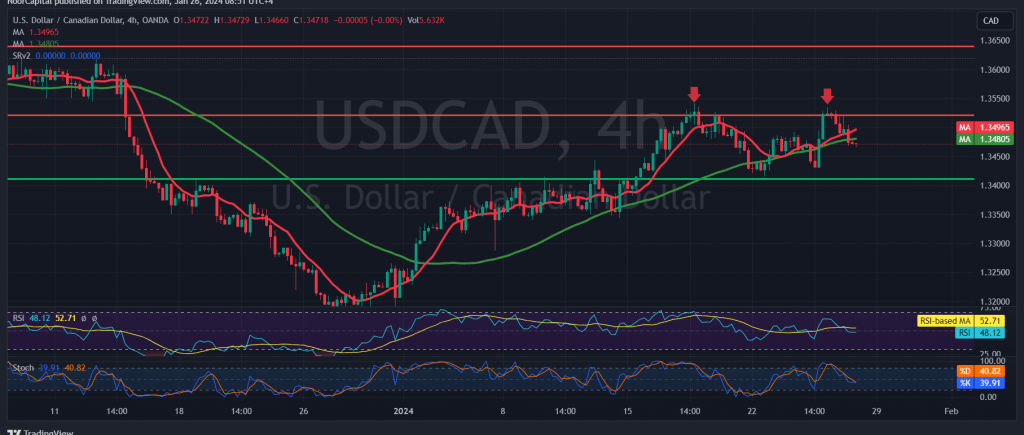

Limited positive attempts dominated the movements of the Canadian dollar temporarily, hitting the resistance level of 1.3535, which succeeded in limiting the upward tendency.

From a technical analysis standpoint, today prices are witnessing stability below the psychological barrier resistance level of 1.3500, and with a closer look at the 4-hour chart, we find that the simple moving averages have returned to pressuring the price from above, accompanied by clear negative signals on the stochastic indicators.

We may witness a bearish bias during today’s trading session, targeting 1.3445, the first target, taking into account that sneaking below the mentioned level will facilitate the task required to visit 1.3390, the next target.

From above, a break up and the price consolidating above 1.3515 is capable of thwarting the proposed scenario and the pair will recover temporarily with the aim of retesting 1.3560.

Warning: The level of risk is high amid continuing geopolitical tensions, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations