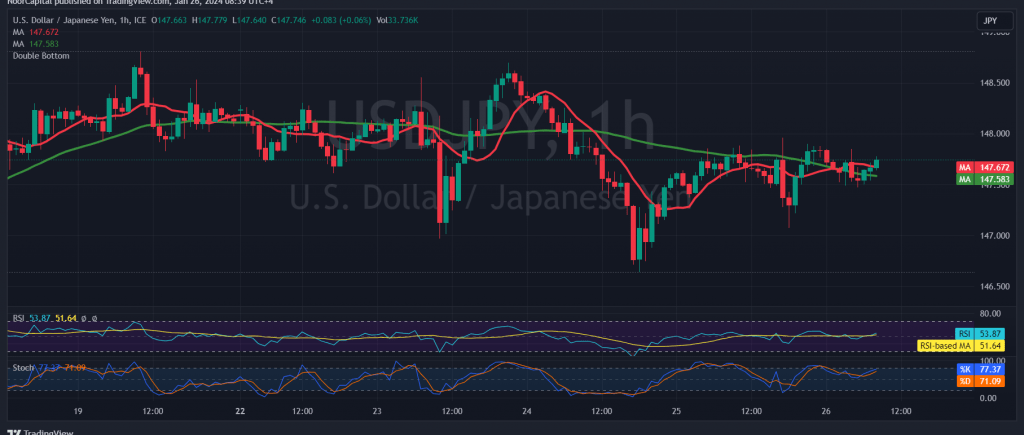

The dollar/yen pair experienced narrow-range side trading in the previous session, maintaining consistent technical conditions with no significant changes in its movements.

From a technical perspective today, examining the 240-minute timeframe chart reveals that the pair found reliable support around 146.65. Moreover, the pair successfully established a base at the 147.20 level, supported by the return of the 50-day simple moving average, which now acts as a lifting force from below.

With these technical indicators, there is a positive inclination, contingent on witnessing a clear and robust breach of the psychological barrier resistance level at 148.00. Such a breakthrough would propel the pair on an upward trajectory, with initial targets set at 148.50, followed by 148.80.

It’s crucial to note that a return to trading stability below 146.65 would reintroduce negative pressure on the pair. In such a scenario, attention turns to support levels at 146.10 and subsequently 145.80.

Warning:

The risk level may be deemed high, and traders are advised to exercise caution and employ risk management strategies given the potential for heightened volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations