The technical outlook for the British Pound against the US Dollar remains largely unchanged, with the currency pair showing efforts to maintain positive stability.

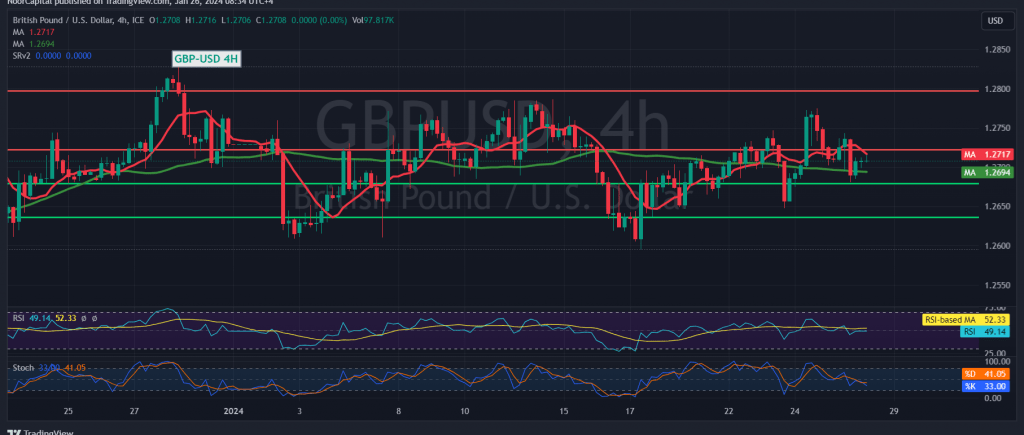

From a technical perspective, the current movements indicate a downward bias, influenced by the price encountering strong resistance around the targeted 1.2780 level. A closer examination of the 4-hour timeframe chart reveals the Stochastic indicator attempting to alleviate the existing negativity. Additionally, the pair is holding steady above the support level of 1.2680 and generally above 1.2650.

Under these conditions, an upward bias is considered the more likely scenario. This is contingent upon a clear and robust breach of the main resistance level for the current trading levels at 1.2730. Such a breakthrough would extend the pair’s gains, with anticipation for further moves towards 1.2780 and 1.2820, respectively.

As a reminder, a return to trading stability below the strong support level of 1.2650 could lead the pair into a downward trend, with initial targets at 1.2580 and potential extension towards 1.2550 at a later stage. Traders and investors should closely monitor these key levels for potential shifts in the currency pair’s direction.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations