The British pound has successfully solidified its position against the US dollar, reaching the initial target specified in the preceding technical report at 1.2780 and achieving its highest point at 1.2775.

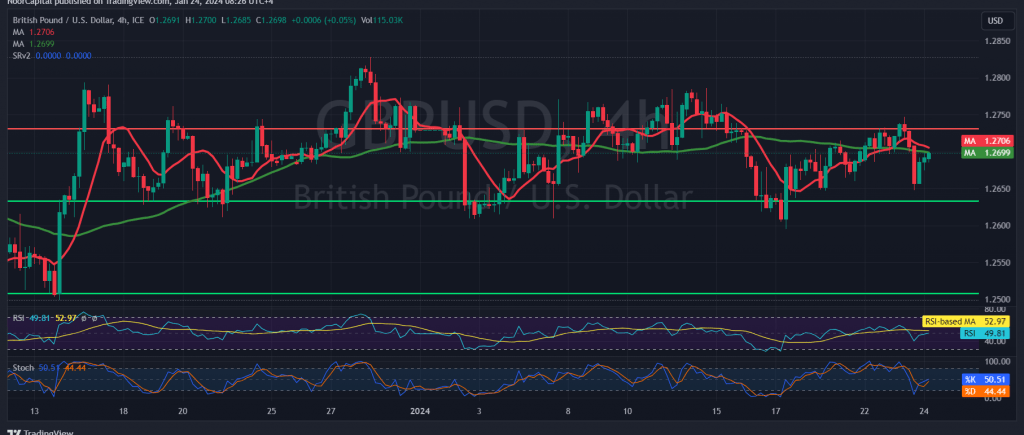

Technically, the present movements exhibit a bearish inclination due to the price encountering robust resistance at the targeted level of 1.2780. Upon closer examination of the 4-hour timeframe chart, the Stochastic indicator is attempting to dispel the current negativity. The currency pair remains stable above the support level of 1.2680, and generally above 1.2650.

In this context, an upward bias is probable, contingent on a clear and robust breach of the primary resistance level at the current trading levels of 1.2730. Such an occurrence would likely extend the pair’s gains, with anticipated targets at 1.2780 and 1.2820, respectively.

It is crucial to note that a return to trading stability below the formidable support level of 1.2650 could redirect the pair towards a downward trend, initiating targets at 1.2580 and potentially extending to 1.2550 later.

Investors should exercise caution today, given the anticipation of high-impact economic data from the Eurozone, including the European Central Bank Monetary Policy Committee statement, interest rate announcements, and the press conference by the President of the European Central Bank. Consequently, significant price fluctuations may be observed during the news release period.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations