Mixed trading characterized the movements of US crude oil futures in the previous session, maintaining a positive stance despite a slightly bearish tone.

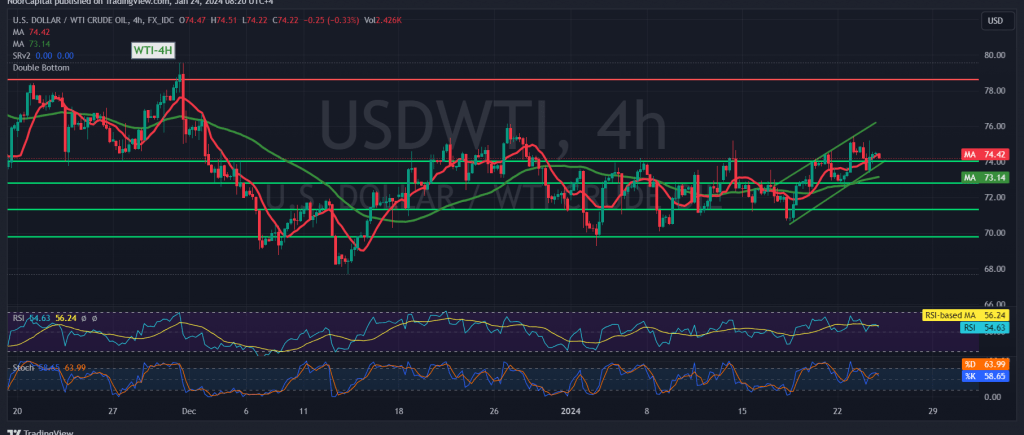

From a technical standpoint, oil prices stabilized above the support level mentioned in the previous report at 73.80, and, in general, they remained above the psychological barrier at 73.00. A closer look at the 4-hour chart reveals continued support from the simple moving average, suggesting a potential for an upward move.

With these technical indications, a positive outlook is maintained, targeting 75.20 as the initial objective. Breaking this level would act as a catalyst, enhancing the likelihood of reaching the subsequent target at 76.00, with potential extensions toward 76.80.

It is crucial to note that slipping below 73.80 delays the prospects of an upward trajectory but does not invalidate them. Instead, a retest of 73.00 may be observed, while a confirmed break below the 73.00 support floor would promptly halt any upward attempts, subjecting oil to notable downward pressure, with targets at 72.55 and subsequently 71.65.

Investors are advised to exercise caution today as high-impact economic data is expected from the American, French, and German economies, including preliminary readings of the services and manufacturing PMI indices. Furthermore, the preliminary reading of the services and manufacturing PMI index from Britain and the Canadian interest rate decision, along with the Bank of Canada press conference, are events that may contribute to increased volatility in the market.

Cautionary Notes:

- Risk Level: High

- Geopolitical Tensions: Ongoing geopolitical tensions may contribute to high-risk conditions and increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations