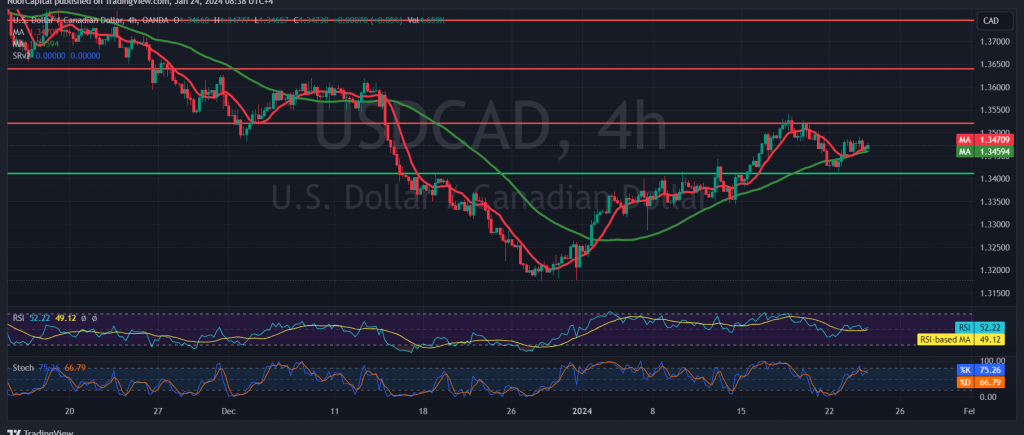

Positive trades were evident in the movements of the Canadian dollar, although positivity remained constrained as the pair stabilized below the formidable resistance level at 1.3500.

From a technical analysis standpoint today, intraday trading shows stability below the psychological barrier resistance of 1.3500. The 14-day momentum indicator has started to provide negative signals, suggesting potential downward movements in the coming hours.

There is a likelihood of a retest of the levels at 1.3430 and 1.3380, respectively. Further losses may extend towards 1.3350 before the pair experiences an upward rebound. It’s important to note that a jump upwards and price consolidation above 1.3530 would nullify the activation of the retesting scenario, leading the pair to resume its upward trajectory towards the previously analyzed targets of 1.3570 and 1.3600.

Cautionary Notes:

- High-Impact Economic Data: Today, the market is anticipating significant economic data from the American economy, including the preliminary readings of the services and manufacturing PMI indices. Similar data is expected from France, Germany, and Britain. Moreover, the Canadian interest rate decision and the Bank of Canada press conference are anticipated. High volatility is likely during the release of this news.

- Risk Level: High, especially amid ongoing geopolitical tensions, contributing to potential high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations