In the latest market developments, US crude oil futures prices experienced a significant surge, achieving noticeable gains and reaching the official target set in the previous technical report at a price of $75.40. The highest level recorded was $75.42 per barrel.

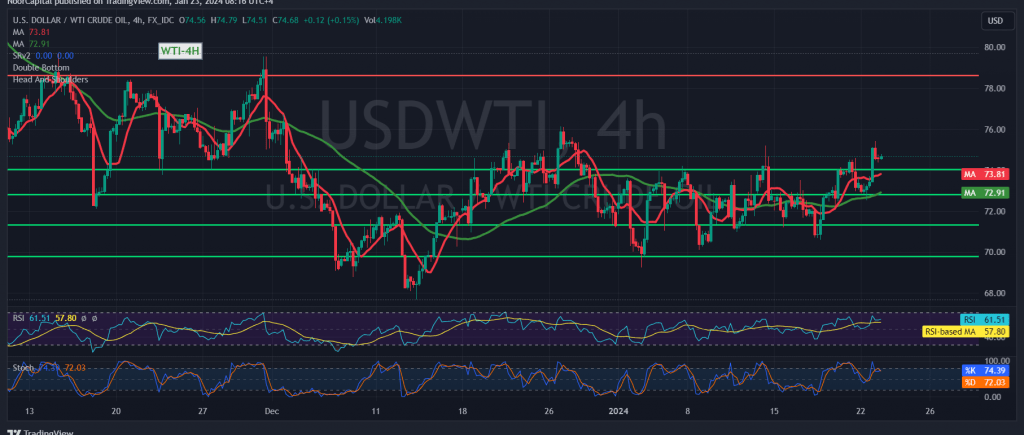

Technically, analyzing the 240-minute time chart reveals that trading has stabilized above the robust resistance level of 73.80. The simple moving averages have also reversed the price trajectory from below, influenced by clear positive signals on the 14-day momentum indicator.

With intraday trading persisting above 73.80, and generally above 73.00, the prevailing expectation is for the upward trend to continue. The initial target is set at 75.85, and a breach of this level would intensify and accelerate the strength of the upward trend, opening the path directly towards 77.00, the next designated station.

It is crucial to note that slipping below 73.80 may delay the potential for further gains, but it doesn’t nullify them entirely. A retest of 73.00 might occur, and confirmation of breaking the support floor at 73.00 would immediately halt any upward attempts, putting oil under significant negative pressure with a target of 71.50.

Warning: The level of risk may be high, especially considering ongoing geopolitical tensions, which could lead to increased price volatility. Traders should exercise caution in such circumstances.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations