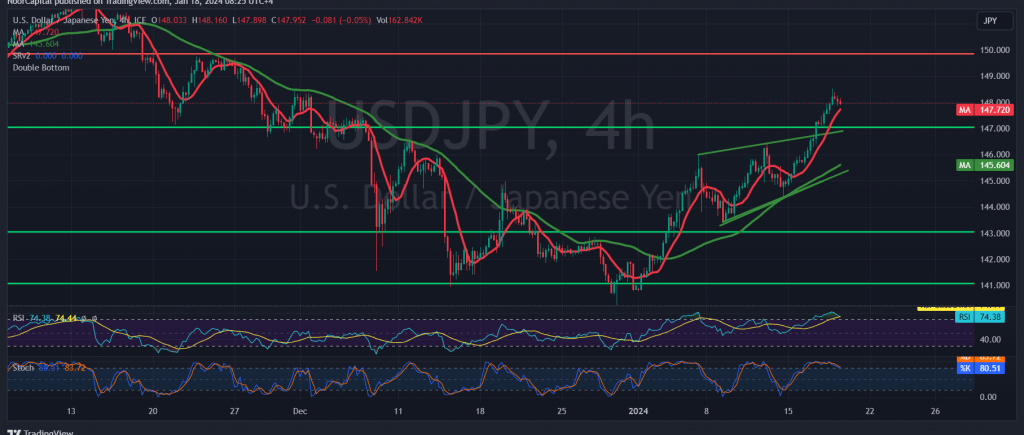

The USD/JPY pair sustained its gains as anticipated within the projected bullish trend, reaching the initial target at 148.00 and edging close to the second target of 148.70, ultimately reaching a peak of 148.52.

From a technical standpoint, the simple moving averages persist in guiding the price from below, reinforcing the continuation of the upward trajectory. However, upon closer examination of the 4-hour chart, indications of overbought conditions are emerging in the pair’s movements.

There is a potential for a bearish bias in the coming hours, aiming to retest the support level at 147.00 before resuming the upward momentum. It’s important to note that this bearish bias doesn’t contradict the overall daily upward trend, which initially targets 148.60 and 149.30.

Warning: The associated risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations