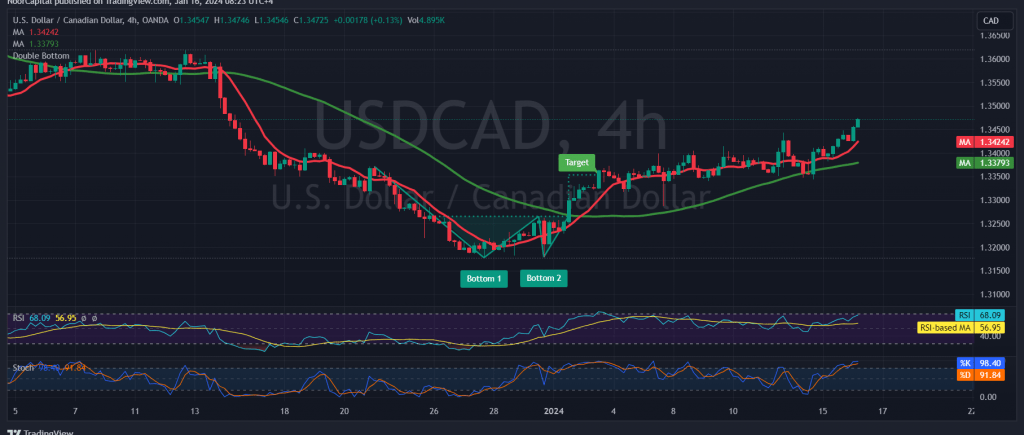

An upward trend has reasserted control over the movements of the Canadian dollar, establishing solid support around 1.3410. The current trading levels witness stability around the highest point reached early in the morning at 1.3475.

Upon closer examination of the 4-hour chart from a technical perspective, the simple moving averages continue to exert upward pressure on the price. This aligns with positive signals from the momentum indicator.

Given the stability of trading above 1.3410, the bullish scenario remains valid and influential. The initial target is set at 1.3500, with a confirmed breach extending the pair’s gains. The subsequent target is 1.3540.

On the downside, breaching below 1.3410 would postpone the likelihood of an upward movement and subject the pair to negative pressure, aiming for a retest of 1.3350.

Note: The 1.3410 level plays a crucial role in the potential trajectory of the pair.

Warning: Today we are awaiting high-impact economic data issued by the American economy “New York State Manufacturing Index” and from the Canadian economy we are awaiting: “Canadian inflation data” and we are anticipating from the United Kingdom “the change in unemployment benefits and the speech of the Governor of the Bank of England” and we may witness high fluctuation in prices at this time. They released the news.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations