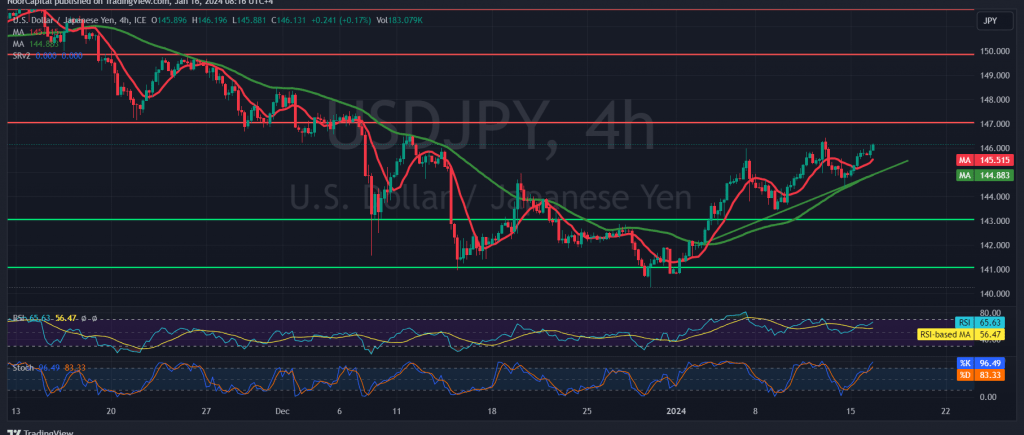

The USD/JPY pair experienced a reversal in its trend, shifting towards an upward trajectory after several consecutive sessions of decline. The pair is now targeting the psychological resistance level of 146.00, having reached its highest point at 146.19.

From a technical perspective, the presence of positive signals is notable. The simple moving averages have reversed to provide positive momentum, coupled with clear positive indications on the 14-day momentum indicator on shorter time intervals. Additionally, the pair is holding steady above the 145.30 support level.

This configuration enhances the likelihood of an upward trend during today’s trading session, with an initial target set at 146.60. Breaking this level further strengthens the pair’s gains, opening the path towards 147.00, an anticipated significant level.

On the downside, a return to stability below 145.25 would prompt the pair to resume the official bearish trajectory, with targets starting at 144.40.

Warning: High-impact economic data is expected today from the American economy (New York State Manufacturing Index), Canadian economy (Canadian inflation data), and the United Kingdom (change in unemployment benefits and the speech of the Governor of the Bank of England). Consequently, market fluctuations may be significant during these releases.

Warning: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations