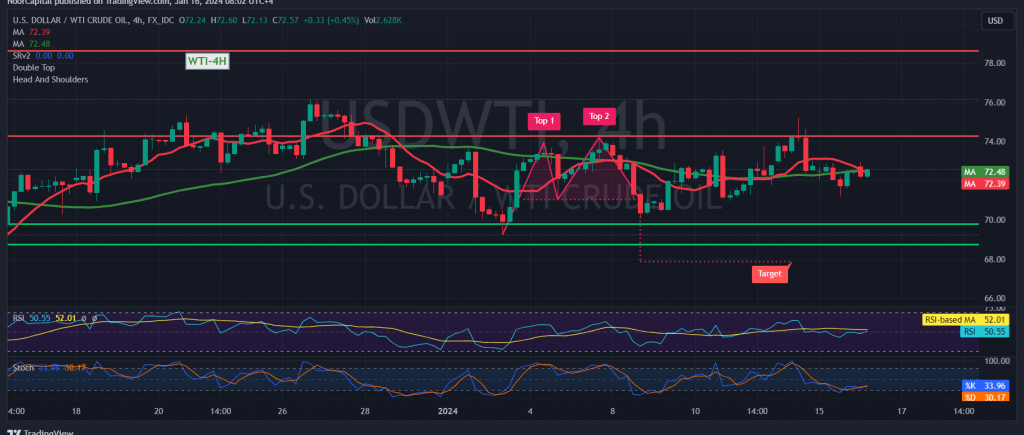

Mixed trading characterizes the movements of US crude oil futures in the initial trading sessions of the week. After reaching its lowest point at $72.27, the price rebounded to retest the $72.50 level.

Technically, a negative bias is evident, supported by the initiation of negative crossover signals from the simple moving averages, exerting pressure on the price from above. The Stochastic indicator also signals a loss of upward momentum.

Intraday trading below 73.15 and, more broadly, below the main resistance level of 73.80 suggests the likelihood of a downward trend. A clear and robust break below the support at 72.20 would facilitate a visit to the first target at 71.50, followed by 70.60, an anticipated station.

It is crucial to note that price consolidation above the pivotal resistance at 73.85 has the potential to thwart downward attempts, initiating an upward move with targets starting at 74.80 and extending to 75.50.

Caution is advised as high-impact economic data is anticipated today, including the “New York State Manufacturing Index” from the American economy, Canadian inflation data, and key updates from the United Kingdom, such as “the change in unemployment benefits” and a speech from the Governor of the Bank of England. Expect heightened price volatility during the release of these news items.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations