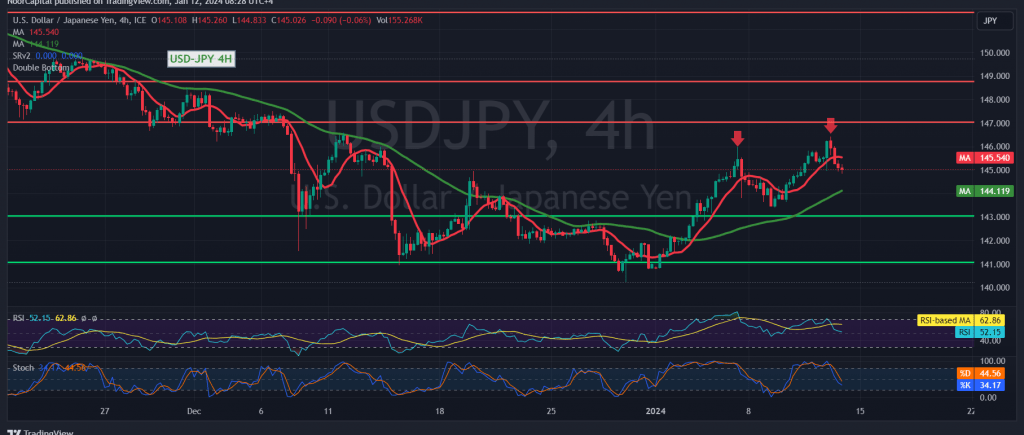

The USD/JPY pair witnessed an upward trend during the previous session, establishing a solid support base around the psychological barrier of 145.00 and reaching its peak at 146.40.

Examining the 4-hour time frame chart from a technical standpoint, indications of negativity are emerging on the Stochastic indicator due to overbought conditions. This has led to a gradual loss of upward momentum, and signs of a temporary decline in momentum are becoming apparent.

In the coming hours, a bearish bias may manifest, targeting a retest of the 50-day simple moving average around 144.10 before potential attempts to resume the upward movement. It’s crucial to note that breaching 146.00 would nullify the idea of a retest and prompt the pair to continue the upward trend, with an initial target at 147.00.

Warning:

- High-impact economic data is expected from the American economy today, including the “monthly core producer prices” and the “monthly producer price index.” Additionally, the “monthly gross domestic product” indicator from the United Kingdom is anticipated, potentially leading to increased volatility during the news release.

Traders should exercise caution and closely monitor market movements, especially during periods of high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations