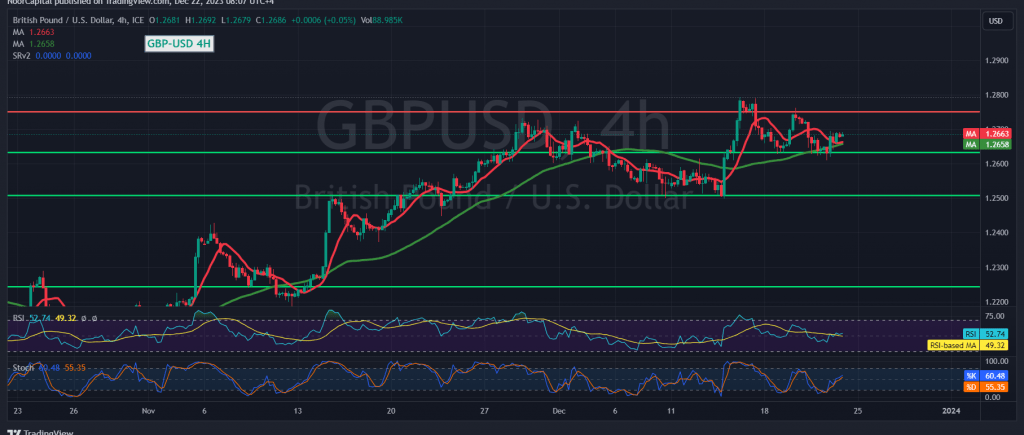

The pound sterling against the US dollar witnessed subdued trading with limited positive attempts, taking advantage of the proximity to the robust support level at 1.2600.

On the technical front today, while the simple moving average offers a positive impetus and aligns closely with the support level of 1.2650, coupled with the Stochastic indicator attempting to dispel intraday negativity, our preference is to observe a breach of 1.2720.

The key to fostering an upward bias in today’s trading session lies in the price’s consolidation and stability above 1.2720, targeting subsequent levels at 1.2750 and 1.2800.

It’s crucial to note that slipping below 1.2635 would redirect the pair towards the official bearish trajectory, with an initial target set at 1.2590.

Warning: Today, we anticipate high-impact economic data from the American economy, including “annual/monthly core personal consumer spending prices” and “Consumer Confidence” issued by the University of Michigan. Additionally, from the United Kingdom, the release of the “Retail Sales” indicator is awaited.

For the Canadian economy, focus is on the monthly “Gross Domestic Product” index. Expect heightened price volatility at the time of news release.

Caution: The risk level is high.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations