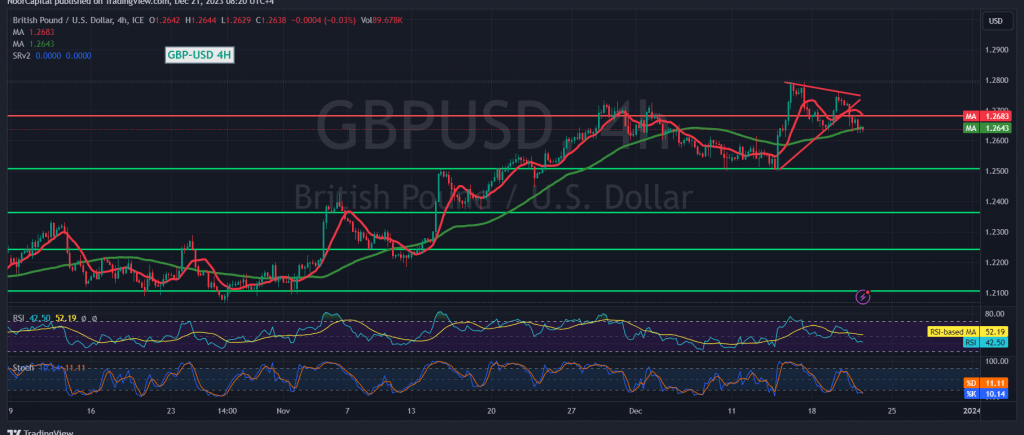

The Pound Sterling against the US Dollar faced challenges in achieving an hourly candle close above the prominent resistance level highlighted in the previous technical report, positioned at 1.2720. This development exerted significant downward pressure, compelling the pair to trade negatively and approach a retest of the targeted level at 1.2660, marking its lowest point at 1.2625.

On the technical front today, a bias towards negativity is apparent, hinging on sustained trading below the psychological barrier resistance of 1.2700. Additionally, the return of simple moving averages to influence the price from above, coupled with clear negative signals on the 14-day momentum indicator, underscores the prevailing bearish sentiment.

Therefore, the preference is for a bearish outlook, with the initial target set at 1.2595. A breach of this level would extend the pair’s losses, opening the path directly towards 1.2555.

Conversely, a scenario in which the price consolidates back above 1.2705 would promptly halt the proposed bearish scenario, leading to a potential recovery for the pair, targeting 1.2775.

Cautionary Note: Today, heightened attention is necessary as we await the release of high-impact economic data from the American economy—the “final reading of gross domestic product” for the quarter. Consequently, expect increased price fluctuation during the news release.

Risk Advisory: The current risk level is elevated.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations