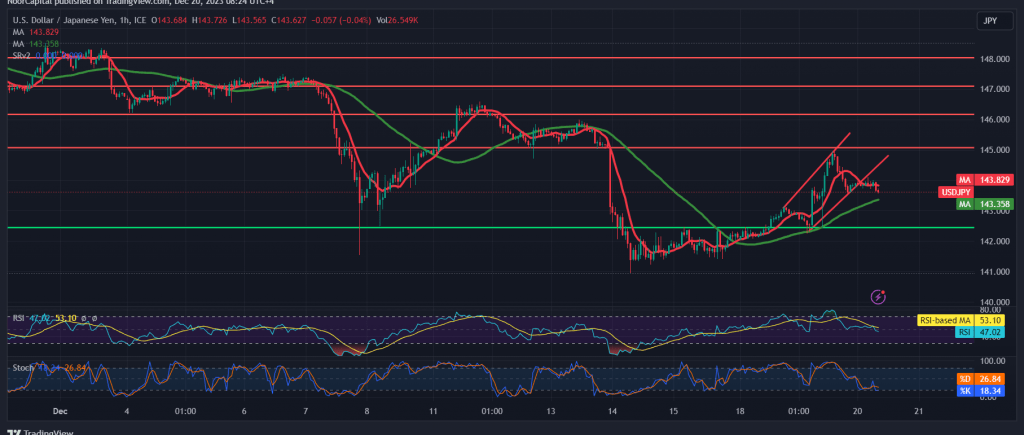

The dollar/yen pair exhibited a significant jump in the previous trading session, aligning with the anticipated bullish trend from the previous technical report. The pair touched the official targets at 144.20 and 144.90, attaining its highest level at 144.95.

From a technical standpoint, the pair encountered robust resistance around the psychological barrier of 145.00, creating a negative pressure factor that dampened the upward momentum. Present movements indicate a downward tendency, influenced by evident negativity on the Stochastic indicator.

There is a likelihood of a bearish tendency in the coming hours, targeting a retest of 142.90 before potential attempts to rise again. It is crucial to closely monitor the price behavior around 142.90, as breaking this level may lead to further downside, with a potential touchpoint at 142.25.

Only a substantial upward movement and price consolidation above 145.00 have the potential to invalidate the proposed scenario, allowing the pair to swiftly complete its rise towards 146.30.

Warning: The risk level is considered high. The quality of the deal may not be commensurate with the expected return. Traders are advised to exercise caution, and prudent risk management is recommended.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations