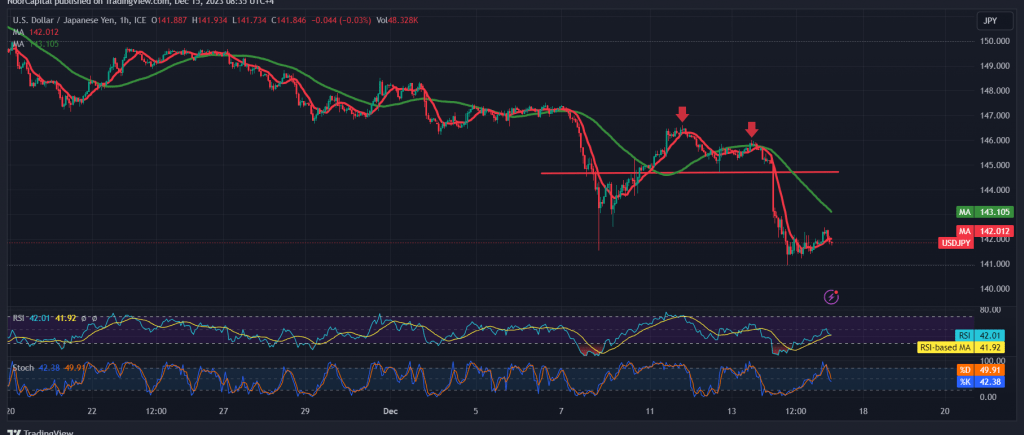

The USD/JPY pair has sustained a negative trading trajectory, with a resilient support base identified around 140.90, as highlighted in the previous technical report. Breaking this level is considered a fundamental condition for the completion of the downward trend.

In today’s technical analysis, indications point to the potential continuation of the bearish trend, drawing support from the ongoing development of simple moving averages exerting strong negative pressure on the price from above. Additionally, the pair has successfully confirmed the breach of the support floor at 142.40.

In light of these factors, it is anticipated that the pair may prolong its decline, particularly if the price descends below 140.90, setting the next official target at 139.90. This outlook holds as long as trading maintains stability below the 142.40 threshold.

It’s crucial to be mindful that price consolidation above 142.40 could prompt a temporary recovery for the pair, with a potential visit to 142.85.

A word of caution is warranted as the risk level is deemed high. The quality of the deal may not align with expectations, and the expected return may not be commensurate with the associated risks. Exercise prudence and assess the risk-reward ratio carefully.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations