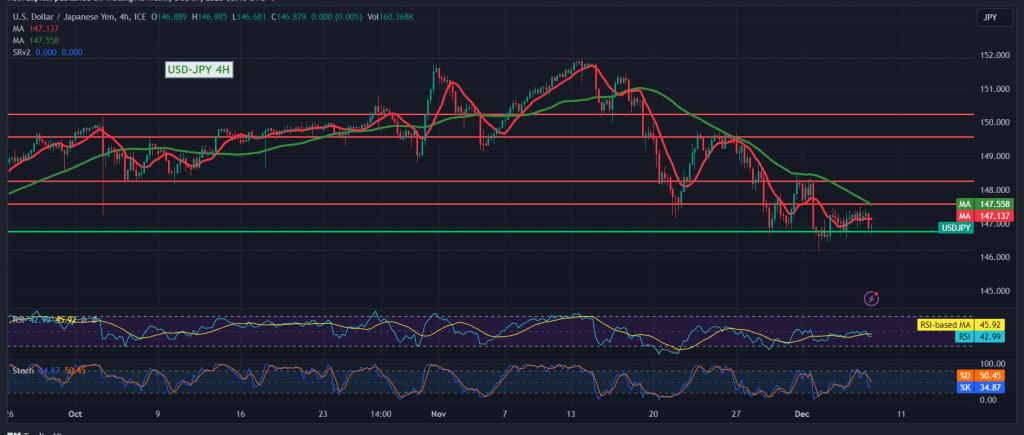

The USD/JPY pair successfully reached the initial bearish target highlighted in yesterday’s technical report, hitting a price of 146.75 and recording its lowest point at 146.70.

From a technical standpoint, there is a general inclination towards a negative stance in our trading strategy. However, upon closer examination of the 4-hour time frame chart, it is noteworthy that the pair is attempting to capitalize on positive stability above the 146.70 support level. This is complemented by the Stochastic indicator’s efforts to gather additional momentum, potentially leading to some temporary gains.

In light of this, as long as trading maintains a position above 146.70, there is a likelihood of witnessing an upward trend in the coming hours, targeting retests at 147.40 and 147.70, respectively. It’s crucial to acknowledge that this temporary upward trend does not negate the official downward trend, with its targets set around 146.20 once the 146.70 support is breached.

A word of caution: The risk level may be high, and careful consideration should be exercised in light of the dynamic market conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations