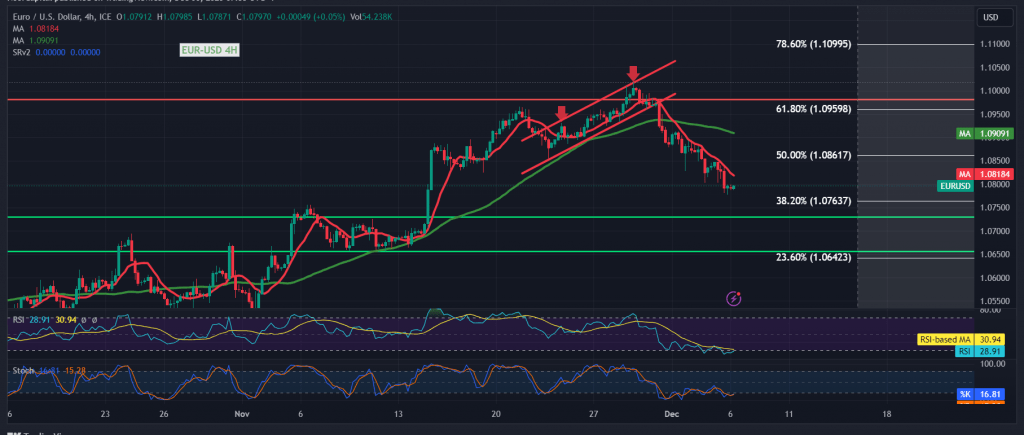

In the aftermath of our previous technical report, the EUR/USD pair continued its anticipated descent, achieving the initial target at 1.0800 and hovering just a few points above the second target at 1.0760. The pair marked its lowest point at 1.0778, confirming the validity of the downward trajectory.

As we assess the current technical landscape, intraday movements indicate a sustained position below the previously breached support level, now acting as a formidable resistance at 1.0860. This level aligns with the 50.0% Fibonacci retracement and finds reinforcement from the 50-day simple moving average, adding an additional layer of strength.

The bearish scenario retains its validity, and a breach below 1.0770 is poised to facilitate a resumption of the downward trend. Initial targets for this scenario lie at 1.0740, with potential extension towards the key level of 1.0700.

An upward crossover, however, hinges on the ability to breach and sustain prices above 1.0860, with a requisite one-hour candle close. This would temporarily shift the odds in favor of a positive session, setting the stage for a retest of 1.0920 and 1.0960, corresponding to the Fibonacci retracement level of 61.80%.

Market participants are urged to exercise caution today, as high-impact economic data from the American economy, specifically the “change in private non-agricultural sector jobs” from Canada, is expected. Furthermore, attention is directed towards the Bank of Canada’s interest rate decision and statement, as well as the press talk by the Governor of the Bank of England. These events may induce heightened price volatility, warranting a vigilant approach during their release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations