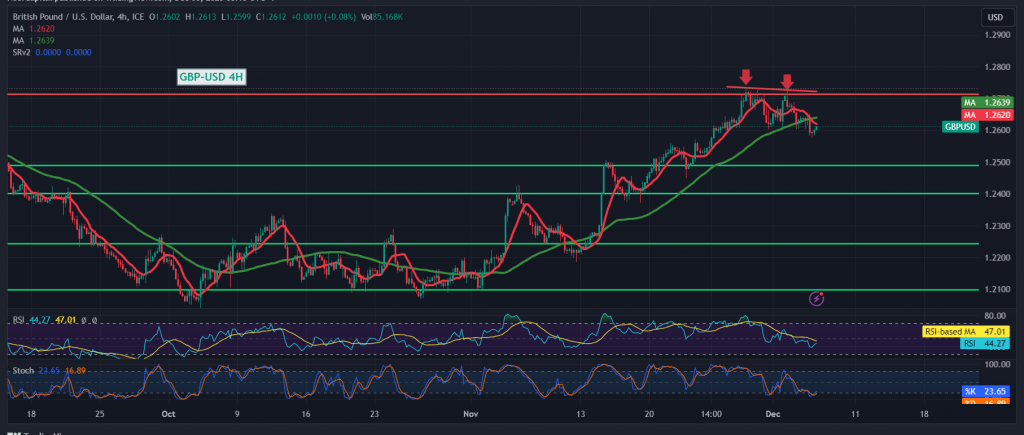

The pound sterling versus the US dollar witnessed a period of narrow-range side trading, reflecting the indecision in the market. In our previous technical report, we maintained an intraday neutral stance due to conflicting technical signals.

In the current technical analysis, the simple moving averages have resumed their influence from above, coinciding with the Stochastic indicator losing upward momentum on the 4-hour time frame.

Our current trading inclination leans towards negativity, particularly as the price remains below the resistance level of 1.2650. The initial target for this negative bias is set at 1.2575, and a breakthrough further intensifies the bearish pressure, paving the way for a visit to 1.2540 and subsequently 1.2500.

On the flip side, a consolidation of prices above 1.2650 has the potential to nullify the bearish scenario. In such a scenario, the pair could experience a recovery with an initial target of 1.2690, followed by extended gains toward the pivotal resistance level of 1.2720.

Investors are advised to approach the market with caution, especially given the anticipation of high-impact economic data from the American economy, specifically the “change in private non-agricultural sector jobs” from Canada. Additionally, the interest statement and rate decision from the Bank of Canada, coupled with the press talk by the Governor of the Bank of England, may induce considerable price fluctuations.

Navigating the current market requires a keen eye on developments and a flexible strategy to adapt to potential shifts in sentiment and volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations